RVI Oil Technical Analysis & RVI Trading Signals

Developed by John Ehlers

The RVI combines the older concepts of technical analysis with modern digital signal processing theories and filters to create a practical & useful indicator.

The basic principle behind it is simple -

- Oil Prices tend to close higher than they open in up-trending markets &

- Oil Prices close lower than they open in down-trending markets.

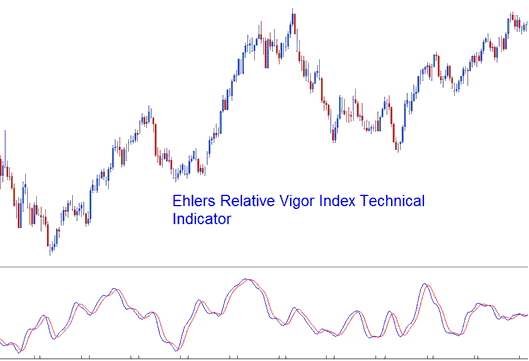

The momentum (vigor) of the move will therefore established by where the crude trading prices end up at the close of the candlestick. The RVI plots two lines the RVI Line and the signal Line.

The RVI index is essentially based on measuring of the average difference between the closing & opening crude oil price, & this value is then averaged to the mean daily trading range and then drawn.

This makes the index a responsive oscillator that has quick turning points that are in phase with the oil market cycles of crude oil prices.

Crude Oil Technical Analysis & How to Generate Trading Signals

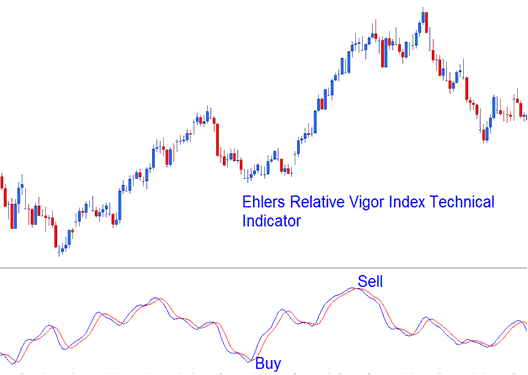

The RVI is an oscillator. Basic technique of analyzing the index is to use the cross-overs of the RVI and the Signal-Line. Signals are generated when the there is a cross-over of the 2 lines.

Bullish Signals - a buy oil signal occurs when the RVI crosses above the Signal Line.

Bearish Signals - a sell oil signal occurs when the RVI crosses below the Signal Line.

Buy & sell oil signals generated using the crossover method