Ehlers MESA Adaptive Moving Average Oil Technical Analysis and Ehlers MESA Trading Signals

Mesa Adaptive Moving Averages was developed by John Ehlers

Originally used to trade commodities and stocks.

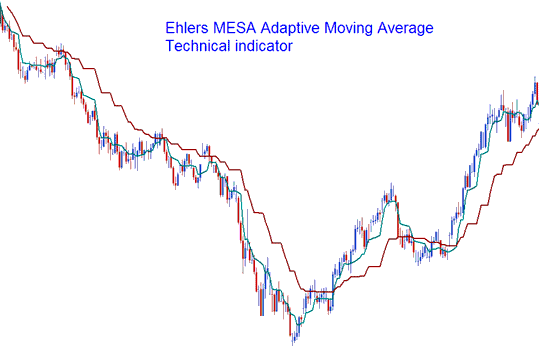

The MESA Adaptive average looks like two moving averages. The difference is that the MESA moves in a staircase manner and not in a curved line like the MA. The example shown below shows this indicator drawn on a crude oil price chart.

Ehlers MESA Adaptive MA

The MESA Adaptive Moving Average is a oil trend following indicator that adapts to crude oil price action movement based on the rate of change of crude oil price as measured by the Hilbert Transform Discriminator. This oil indicator will generate a trade signal when the two MAs cross one another. Trades should be executed in direction of the MESA averages.

This method features a fast MA and a slow MA so that composite average rapidly follows behind the crude oil price changes and holds the average value until the next candlestick close occurs. This oil indicator is less prone to whipsaws compared with the original Moving averages. This is because of its formula used to calculate the rate of change in relation to the crude oil price movement.