Stochastic Oscillator Oil Technical Analysis & Stochastic Oscillator Crude Oil Trading Signals

Developed by George C. Lane

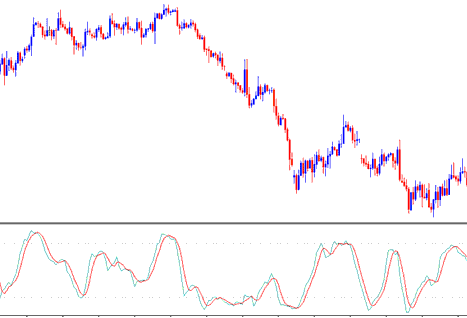

The Stochastic Oscillator is a momentum indicator - it shows the relation between the current closing crude crude oil price relative to the high and low range over a given number of n periods. Oscillator uses a scale of 0-100 to draw its values.

This Oscillator is based on the theory that in an up oil trend market the crude crude oil price closes near the high of the crude crude oil price range and in a downwards trending market the crude crude oil price will close near the low of the crude crude oil price range.

The Stochastic Lines are drawn as 2 lines- %K and %D.

- Fast line %K is the main

- Slow line %D is the signal

3 Types of Stochastics Oil Oscillators: Fast, Slow and Full Stochastics

There are Three types are: fast, slow & full Stochastic. The 3 indicators look at a given chart period for example the 14-day period, & measures how the crude crude oil price of today's close compares to the high/low range of the time period that is being used to calculate the stochastic.

This oscillator works on the principle that:

- In an upward oil trend, crude crude oil price tends to close at the high of the candlestick.

- In a downwards oil trend, crude crude oil price tends to close at the low of the candlestick.

This oil indicator shows the momentum of the Oil trends, & identifies the times when a market is overbought or oversold.

Crude Oil Technical Analysis & Generating Oil Trading Signals

The most common techniques used for technical analysis of Stochastic Oscillators to generate oil signals are cross overs signals, divergence signals and overbought oversold levels. following are the techniques used for generating trade signals

Crude Oil Trading Crossover Oil Trading Signals

Buy signal – %K line crosses above %D line (both lines moving upwards)

Sell signal - %K line crosses below the %D line (both lines moving downwards)

50-level Crossover:

Buy signal – when stochastic lines cross above 50 a buy crude oil trade signal is generated.

Sell signal - when stochastic lines cross below 50 a sell crude oil trade signal is generated.

Divergence Crude Oil

Stochastic is also used to look for divergences between this indicator and the crude crude oil price.

This is used to determine potential oil trend reversal oil signals.

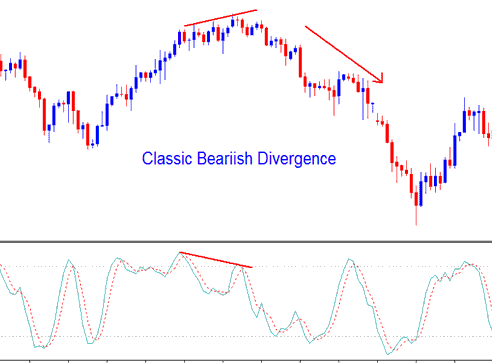

Upwards/rising oil trend reversal- identified by a classic bearish divergence

Oil Trend reversal – identified by a classic bearish divergence

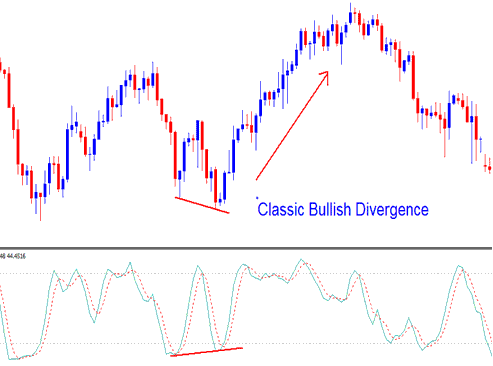

Downwards/descending oil trend reversal- identified by a classic bullish divergence

Oil Trend reversal - identified by a classic bullish divergence

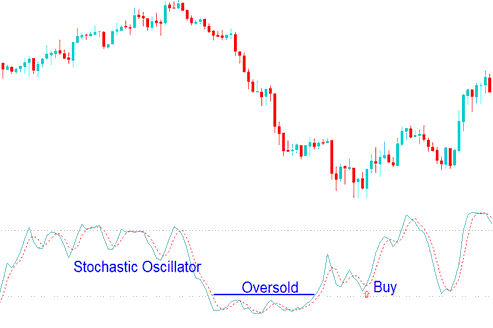

Oversold/Overbought Levels on Oil Indicator

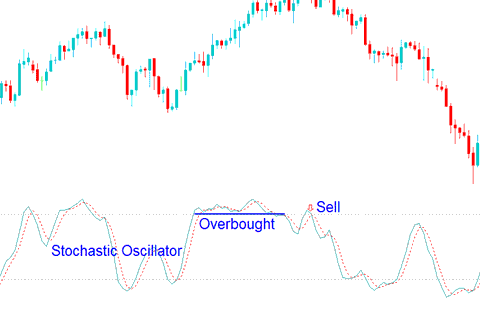

Stochastic is mainly used to identify potential overbought & oversold conditions in crude oil price movements.

- Overbought values greater than 70 level - A sell oil signal occurs when the oscillator rises above 70% and then falls below this level.

Overbought - Values Greater 70

- Oversold values less than 30 level - a buy oil signal is generated when the oscillator goes below 30% and then rises above this level.

Oversold – Values Less Than 30

Trades are generated when Stochastic Oscillator crosses these levels. However, overbought/oversold levels are prone to whipsaws especially when the crude crude oil market is trending upward or downward.