Reversal Crude Oil Candlestick Patterns and Their Confirmation: Hammer Oil Trading Candlestick Pattern & Hanging Man Oil Trading Candlestick Pattern

Hammer Bullish Crude Oil Candle Patterns

Reversal candle-stick patterns occur after an extended prior trend. Therefore, for a candle pattern to qualify as a reversal oil pattern there must be a prior trend.

These reversal candlestick patterns are:

- Hammer Oil Trading Candlestick Pattern & Hanging Man Crude Oil Candlestick Pattern

- Inverted Hammer Oil Candlestick Pattern & Shooting Star Crude Oil Candlestick Pattern

- Piercing Line Oil Candle-Stick Pattern and Dark Cloud Cover Crude Oil Candlestick Pattern

- Morning Star Candlesticks & Evening Star Candlesticks

- Engulfing Crude Oil Candles Patterns

Hammer Crude Trading Candlestick Pattern & Hanging Man Crude Oil Candle Stick Pattern

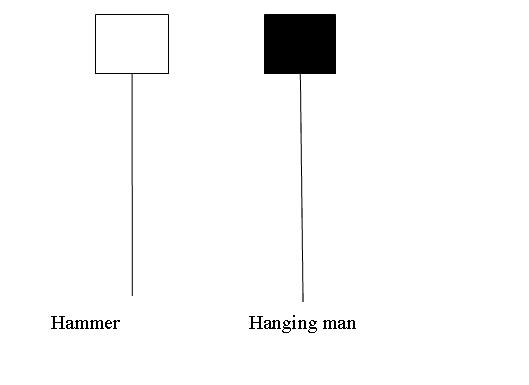

Hammer Oil Trading Candlestick Pattern & Hanging Man Oil Candle-Stick Pattern look alike but hammer is bullish reversal oil pattern and hanging man is a bearish reversal oil pattern.

Hammer Crude Trading Candlestick Pattern & Hanging Man Oil Trading Candlestick Pattern

Hammer Candlestick

Hammer is a potentially bullish pattern which occurs during a oil downwards trend. It is named so because the oil market is hammering out a market bottoms.

A hammer has:

- A small body

- The body is at the top

- The lower shadow is two or three times length of the real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body isn't important

Hammer Candle

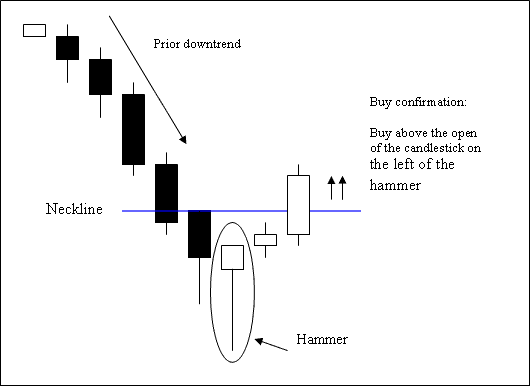

Technical Analysis of Hammer Crude Oil Candles Pattern

The buy oil signal is confirmed when a candlestick closes above the opening crude oil price of the candlestick on the left side of the hammer candlestick pattern.

Stop orders should be set a few pips just below low of the hammer candle-stick.

Hanging Man Candlestick

This oil pattern is a potentially bearish reversal oil signal which occurs during a oil upward trend. It's named so because it resembles a man hanging on a noose up high.

A hanging man candlestick has:

- A small body

- The body is at the top

- The lower shadow is two or three times length of the real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body isn't important

Hanging Man Candle

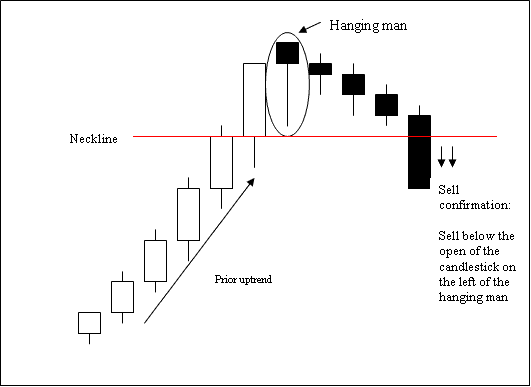

Technical Analysis of Hanging Man Crude Oil Candlesticks

The sell oil signal is confirmed when a bearish candle closes below the open of the candle on left-side of this hanging man candle pattern.

Stop orders should be set few pips just above the high of hanging man candle.