How to Draw Oil Trend-Lines & Channels on Crude Trading Charts

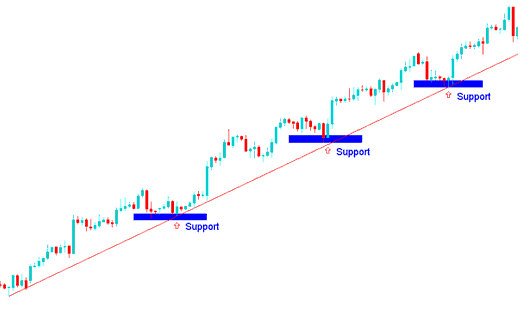

Sometimes support & resistances are formed diagonally in a similar way like a staircase. This forms a oil trend which is a sustained movement in one direction either upwards or downward.

A oil trend line depicts the points of support and resistance for the crude trading price, depending on the direction of the market. For an upward moving oil market oil trend - oil trend line will shows the points of support and for a downward moving oil market oil trend - oil trend line will show the areas of resistance - oil trend lines are mainly used by many crude oil traders to determine these resistance and support levels on crude oil charts.

A Oil Trend line is a slanting straight line that connects two or more crude oil price points and extends into the future to act as a zone of support or resistance for the trading price movement. There are two types of oil trend lines: upward oil trend line and downward oil trend line. Oil trend line is an aspect of crude trading analysis that uses oil line studies to try and predict where the next crude trading price move will head to. A trader must know how to draw & interpret oil signals generated by this oil trend line tool.

The basis of this oil technical analysis is based upon the idea that oil markets move in trends. Oil trend lines are used to show 3 things.

- The general direction of the market - up or down.

- The strength of the current oil trend - and

- Where future support and resistance will be likely located

If oil trend lines forms in a certain direction then the oil market usually moves in that direction for a period of time until a time when this oil trend-line is broken.

Drawing these oil trend-lines on a oil chart shows the general oil trend of the oil market which can either be upward or downward.

Shown Below is example of how to draw these oil trend lines on crude oil charts

Tutorial:How to Draw Upward Oil Trend-Line and Trade Upward Oil Trend Move

Tutorial: How to Draw Oil Trading Downwards Oil Trendline & Trade Downwards Oil Trend Move

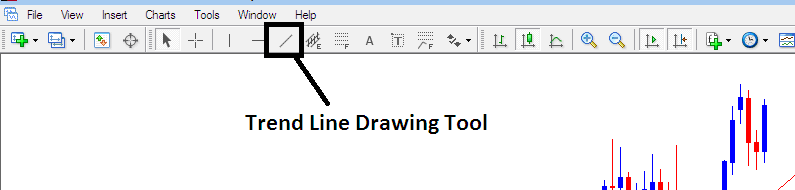

The MT4 oil trading software provides oil charting tools for drawing these oil trend lines on crude oil charts. To draw oil trend lines onto a oil chart, crude oil traders can use the oil tools provided on the MT4 software that is shown below.

To draw oil trend-lines on a oil chart just click the Crude Oil MT4 Draw Oil Trend Line Tools as shown above on the MT4 platform technical analysis software and select point A where you want to start drawing the oil trend line and then point B where you want the oil trend line to touch. You can also right-click on the oil trend line & on the properties option choose the option to extend its ray by ticking "ray check box", if you don't want to extend the oil trendline, then uncheck this option in your MT4 platform. You can also change other oil trend line properties such as color and width on this property popup window of the oil trend line properties. You can download MT4 software and learn oil trend line technical analysis with it.

The oil trend is your friend. Is a popular saying among traders because you should never go against it. This is the most reliable technique to trade Oil Trading because once crude trading prices begin to move in one direction they can continue to move in that particular direction for quite some time - therefore using this oil trend technique presents opportunity to make profits from the crude oil market.

Principles of How to Draw Oil Trend Lines

Use oil candle charts

- The points used to draw the oil trendline are along the lows of the crude trading price bars in a rising crude oil market. An upward bullish oil trend move is defined by higher highs and higher lows.

- The points used to draw the oil trendline are along the highs of the crude oil price bars in a falling downwards market. A downwards bearish oil trend move is defined by lower highs and lower lows.

- The points used to draw oil trend lines are extremes points - the high or the low crude trading price. These extremes are important because a close beyond the extreme tells investors the oil trend of oil might be changing. This is an entry or an exit signal.

- The more often a oil trend-line is hit but it's not broken, the more powerful its signal.

There are 2 main ways of trading this oil trend line technical analysis set-up:

- The Oil Trend-Line Bounce - Oil Trend Line Bounce

- The Oil Trendline Break - Oil Trend-Line Break

Technical Analysis Methods of Oil Trend Lines

The oil trend-line bounce is a continuation oil signal where crude trading price bounces off this oil trend line to continue moving in the same direction. In a downward oil trend, the oil market will bounce downwards after hitting this oil trend line level which is the resistance level. In an upward oil trend, the oil market will bounce upwards after hitting this oil trend line level which is the support level.

The oil trend-line break is a reversal oil signal where the oil market goes through the oil trend line & starts moving in the opposite direction. When a oil up trend is broken then the sentiment of the oil market reverses and becomes bearish and when a oil down trend is broken then the oil market sentiment reverses and becomes bullish.

For very strong oil trends, after this oil trend line break trading signal, the crude trading price will consolidate for some time before moving in the opposite direction. For short term oil trends then this oil trend-line break oil signal will mean crude oil price may reverse direction immediately.

In crude oil, both the oil trend line bounce & the oil trend-line break that are used in technical analysis charts are based upon these oil trend line levels being support and resistance levels.

Entry, Exit & Setting stops:

This oil trend line trading method is used to determine good entry and exit points, protective stops are placed just above or below these oil trend lines. The oil trend line bounce is a low-risk entry method used by crude oil traders to place entry trades after crude trading price has retraced. Oil trades are setup along these oil trend line levels and a stop loss placed just above or below these oil trend lines.

The oil trend-line break is a crucial technical indicator of possible oil trend reversal. When the oil trend line is broken the crude trading price starts move in the opposite direction. This provides an early exit signal for crude oil traders to exit their open trades and take profits. When there a penetration of these oil trend line levels, it is a signal that the crude oil price can start moving in opposite direction.

Unlike other oil technical analysis indicators there is no formula used to calculate the oil trend line, this oil trend line formation is just drawn between two chart points on the crude oil chart.