Hidden Bullish and Oil Hidden Bearish Divergence Crude Oil

Hidden divergence is used as a possible sign for a oil trend continuation after the crude oil price has retraced. It's a signal that the original oil trend is resuming. This is best set up to trade because it is in same direction as that of the continuing market trend.

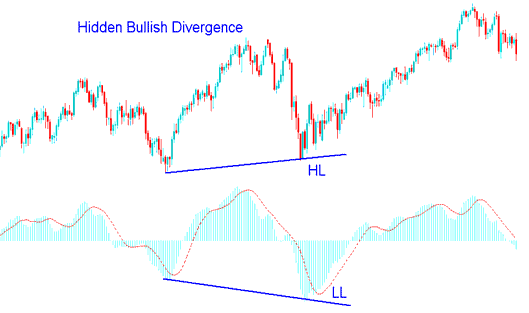

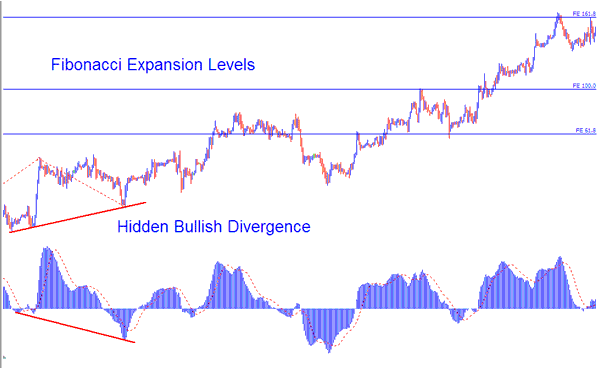

Oil Hidden Bullish Divergence

This setup happens when crude oil price is forming a higher low (HL), but the oscillator (indicator) is showing a lower low (LL). To remember them easily think of them as W-shapes on Chart patterns. It occurs when there is a retracement in an upward crude oil trend.

The example shown and illustrated below shows an image of this oil setup, from the screenshot the crude oil price made higher low (HL) but the indicator made a lower low (LL), this shows that there was a diverging signal between the crude oil price and indicator. This signal shows that soon the oil market up oil trend is going to resume. In other words it shows this was just a retracement in an upwards oil trend.

This confirms that a retracement move is complete and indicates underlying strength of an upward crude oil trend.

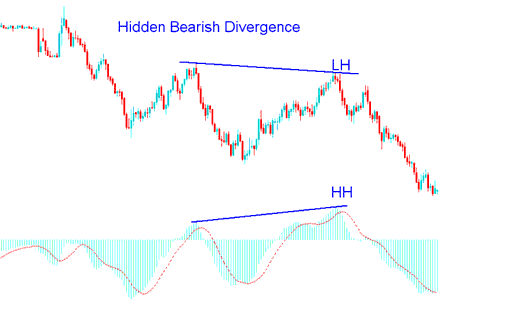

Crude Trading Hidden Bearish Divergence

This setup happens when crude oil price is forming a lower high (LH), but the oscillator is showing a higher high (HH). To remember them easily think of them as M-shapes on Chart patterns. It occurs when there is a retracement in a downward crude oil trend.

The example shown and illustrated below shows an image of this oil setup, from the screenshot the crude oil price made lower high (LH) but the indicator made a higher high (HH), this shows that there was a divergence between the crude oil price & the indicator. This shows that soon the oil market down oil trend is going to resume. In other words it shows this was just a retracement in a downward trend.

This confirms that a retracement move is complete and indicates underlying strength of a downward crude oil trend.

Other popular technical indicators used are CCI indicator (CCI), Stochastic Oscillator, RSI and MACD. MACD & RSI are the best indicators.

NB: Hidden divergence is the best type to trade because it gives a signal that's in the same direction with the current market trend, thus it has a high reward to risk ratio. It provides for best possible entry.

However, a trader should combine this oil setup with another indicator like the stochastic oscillator or moving average and buy when the oil is oversold, and sell when the oil is overbought.

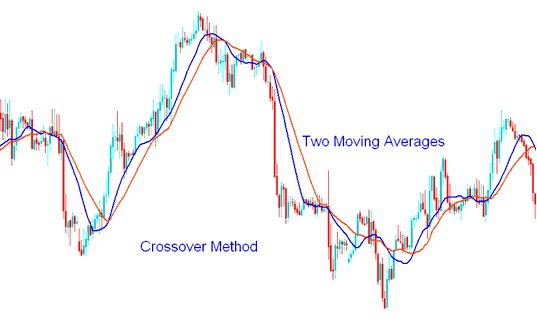

Combining Hidden Divergence with Moving Average Crossover Method

A good indicator to combine these oil setups is the moving average indicator using the moving average cross-over method. This will create a good trading strategy.

Moving Average Crossover Technique

In this strategy, once the signal is given, a trader will then wait for the moving average cross over method to give a buy/sell oil signal in the same direction, if there is a bullish divergence set up between the crude oil price and indicator, wait for the moving average crossover system to give an upwards cross over signal, while for a bearish diverging setup wait for the moving average crossover system to give a downward bearish crossover signal.

By combining this oil signal with other technical indicators this way one will avoid whip-saws when it comes to trading this oil signal.

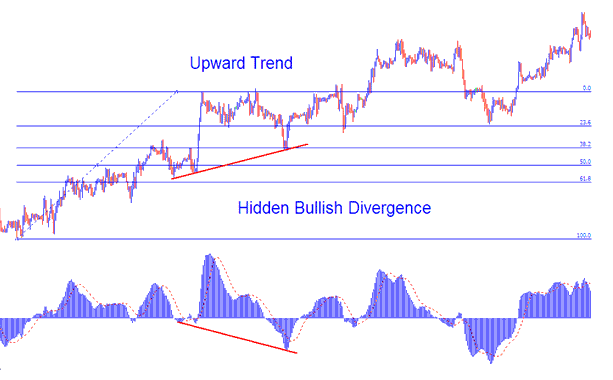

Combining with Oil Trading Fib Retracement Levels

For this example we shall use an upward market trend. We shall use MACD indicator.

Because the hidden divergence is just a retracement in an upward oil trend we can combine this oil trading signal with the most popular retracement tool that is the Fibonacci retracement levels. The example shown and illustrated below shows that when this oil set-up appeared on the chart, the crude oil price had just hit the 38.2% level. When crude oil price tested this level, this would have been a good level to place a buy order.

Combining with Oil Trading Fib Expansion Levels

In the oil example above once the buy oil trade was placed, a trader would then need to calculate where to place the take profit for this trade. To do this one would need to use the Oil Trading Fib Expansion Levels.

The Fibo expansion was drawn as shown & illustrated on oil chart as shown and illustrated below.

For this example there were 3 take profit areas:

Expansion Level 61.80% - 131 pips profit

Expansion Level 100.00% - 212 pips profit

Expansion Level 161.80% - 337 pips profit

From this strategy combined with Fibonacci would have provided a good strategy with a good amount of profit set using these take profit levels.