Bilateral/Consolidation Crude Trading Chart Patterns Oil

With bilateral/consolidation crude trading patterns the oil market can move in any direction. There are two types of consolidation oil chart patterns that form on oil charts:

- Symmetric Triangles - Consolidation crude trading chart patterns

- Rectangles - Range/ranging market

Consolidation Oil Trading Patterns

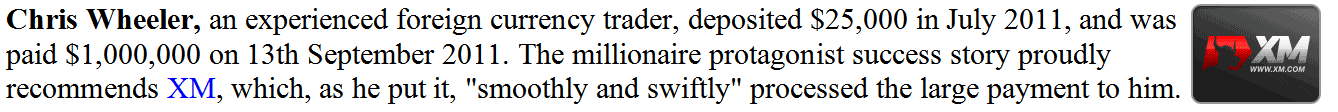

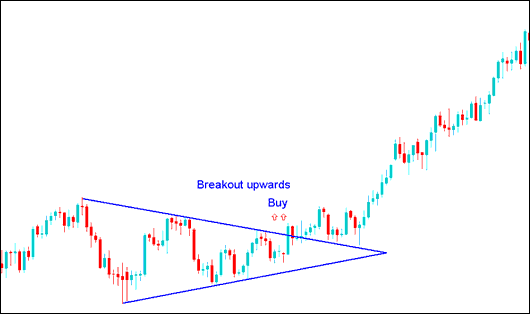

Symmetrical triangles are oil chart patterns with converging oil trend lines that form a consolidation period. The technical buy point from a symmetrical triangle is the upside break, while a downside break is a technical sell oil signal. Ideally, a market breaks out from a symmetrical triangle prior to reaching apex of the triangle.

Oil Trend-lines can be drawn connecting the lows & highs of the consolidation phase, the oil trend lines formed are symmetric and converge to form an apex. A breakout should occur somewhere between 60-80% into the triangle oil pattern. An early or late breakout is more prone to failure, and therefore less reliable. After a crude oil price breakout the apex forms support and resistance levels for the crude oil price. Oil Price that has broken out of the apex should not retrace past the apex. The apex is used as a stop loss setting area for the open Oil trades.

When these consolidation patterns form we say that the crude oil market is taking a pause before deciding next direction to take.

These consolidation patterns form when there is a tug of war between the buyers and the sellers and the crude oil market can not decide which way to move.

Consolidation Crude Trading Chart Pattern

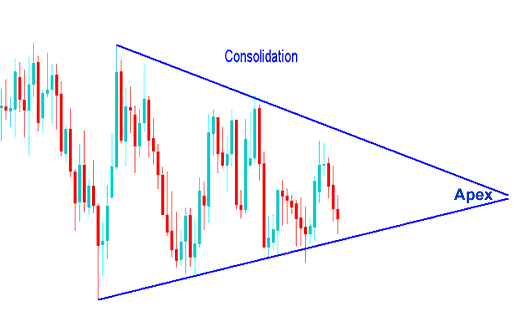

However, this pattern cannot go on forever and just like in a tug of war one side eventually wins, looking at the crude oil chart below see how the consolidation eventually had a breakout and moved in one direction. Now how do we make sure that we are on the winning side?

Break out Downwards Sell Oil Signal after a Consolidation

Breakout Upwards Buy Oil Signal after a Consolidation

Now back to our question, how do we make sure we are on the winning side?

Well we wait until crude oil price moves past one of the lines and put buy or sell orders in that direction. After consolidating, If crude oil price breaks the upper line we buy, if it breaks out the lower line we sell.

Alternatively if you do not want to wait out the consolidation, you can use pending oil orders. If you would like to know more about pending oil orders go to the topic: Stop Entry Oil Trading Order Types

The two types of stop order types used to trade consolidation crude trading chart patterns are:

- Buy Entry Stop An order to buy at a level above crude oil price.

- Sell Entry Stop An order to sell at a level below crude oil price.

These are oil orders to buy above the oil market or to sell below the crude trading market.

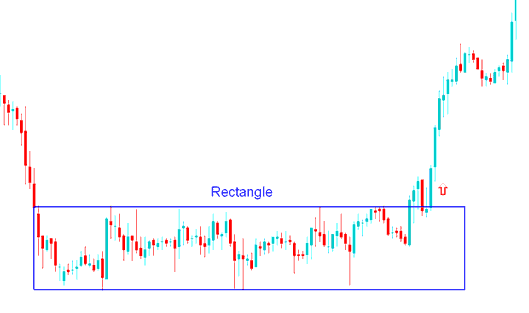

Rectangle Oil Trading Pattern

A rectangle consolidation pattern is a trading range with narrow crude oil price action which forms a consolidation phase in crude trading market. The trading range is defined by two parallel oil trendlines which are horizontal and indicate the presence of support and resistance. This oil pattern is drawn on a oil chart using a rectangle, hence the name rectangle crude trading chart pattern.

For this consolidation oil chart pattern, crude oil price forms multiple highs and lows that can be connected with horizontal oil trendlines that are parallel to each other. This oil pattern forms over an extended period of time giving the pattern its rectangle shape.

A breakout of crude oil price action from this consolidation pattern occurs when either of the horizontal line is penetrated and the trading range of this rectangle is broken. An upside breakout is a buy oil signal. A downside breakout is a sell oil signal.

Rectangle Pattern Oil Trading - Consolidation Pattern

Oil Price Breaks the consolidation range after sometime & continues to move upward after an upward market breakout.