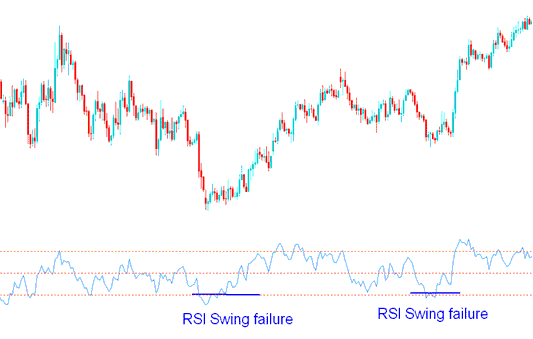

RSI Swing Failure Oil Trading Setup

RSI oil swing failure can be a very accurate method for trading short term oil moves. It can also be used for trading long term oil trends but it is best suited for short term oil especially for those oil traders that trade reversals.

The RSI swing failure swing oil setup is a confirmation of a pending oil market reversal. This oil swing failure setups a leading breakout signal, it warns that a support or resistance level in the oil market is going to be penetrated. This oil setup should occur at values above 70 for an upward oil trend and values below 30 in a downward crude oil trend.

Swing Failure In an Upwards Oil Trend

If the oil RSI Oil Technical Indicator hits 79 then pulls back to 72, then rises to 76 and finally drops to below 72 this is considered a failure swing oil RSI setup. Since the 72 level is an RSI support level and it has been penetrated it means that crude oil price will & follow & it will penetrate its support level.

In the oil example shown below, the oil RSI indicator hits 73 then pulls back to 56, this is a support level. The oil indicator then rises to 68 and then drops to below 56, thus breaking the support level. The crude trading price then follows afterwards breaking it support level. The oil RSI swing failure is a leading oil signal and it is confirmed when crude trading price also breaks it support level. Some traders open trades once the swing failure is complete while other oil traders wait for crude trading price confirmation, either way it is for a trader to decide what work best for them.

Oil Trading RSI Swing Failure Setup in an Upward Oil Trend

Swing Failure In a Downwards Oil Trend

If the oil RSI Oil Technical Indicator hits 20 then pulls back to 28, then falls to 24 and finally penetrates above 28, this is considered a failure swing setup. Since the 28 level is an RSI resistance level and it has been penetrated it means that crude oil price will & follow & it will penetrate its resistance level.

Oil Trading RSI Swing Failure Setup in a Downward Oil Trend