MACD Oil Classic Bullish & Bearish Divergence

MACD Oil Trading Classic divergence is used as a possible sign for a oil trend reversal. MACD classic divergence is used when looking for an area where crude trading price could reverse and start going in the opposite oil trend direction. For this reason MACD classic divergence is used as a low risk entry method and also as an accurate way of exit out of a crude oil trade.

1. It is a low risk technique to sell near the oil market top or buy near the oil market bottoms, this makes the risk on your crude oil trades are very small relative to the potential reward.

2. It's used to predict the optimum point at which to exit a Oil trade.

There are two types of Oil Trading Classic Divergence:

- Crude Oil Classic Bullish Divergence

- Oil Classic Bearish Divergence

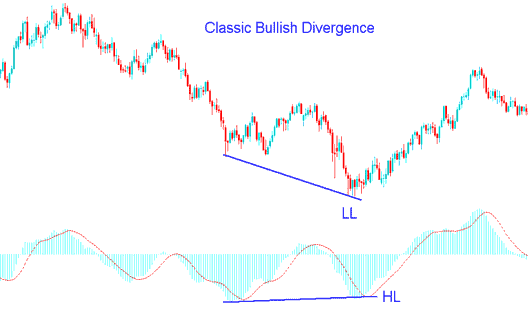

Oil Classic Bullish Divergence in Oil

Classic bullish divergence in oil occurs when crude oil price is forming lower lows ( LL ), but the oscillator technical indicator is forming higher lows ( HL ).

MACD Oil Classic Bullish Divergence in Crude Trading - MACD Divergence Strategy

Classic bullish divergence in oil warns of a possible change in the oil trend from down to up. This is because even though the crude oil price went lower the volume of sellers that pushed the crude trading price lower was less as illustrated by the MACD indicator. This indicates underlying weakness of the downward crude oil trend.

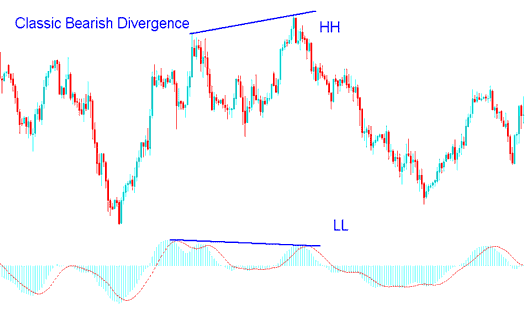

Classic bearish divergence in Oil

Classic bearish divergence in oil occurs when crude oil price is showing a higher high ( HH ), but the oscillator technical indicator is showing a lower high ( LH ).

MACD Oil Classic Bearish Divergence in Crude Trading - MACD Divergence Oil Strategy

Classic bearish divergence warns of a possible change in oil market oil trend from up to down. This is because even though the crude oil price went higher the volume of buyers who pushed the crude trading price higher was less as illustrated by the MACD indicator. This indicates underlying weakness of the upward crude oil trend.