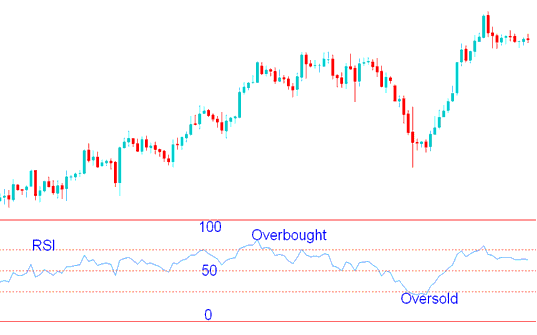

RSI Oil Indicator Overbought and Oversold Levels

RSI technical indicator values of above 70 are considered to be over bought: oil traders consider points above the 70 level as market tops and good points for taking profits.

RSI technical indicator values of below 30 are considered to be over sold: oil traders consider points below the 30 level as market bottoms & good points for taking profits.

These overbought and oversold oil levels should be confirmed by RSI center line crossovers oil signals. If these regions give a market top or bottom, this oil signal should be confirmed with RSI center line crossover oil signal. This is because these overbought and oversold levels are prone to giving whipsaws in the crude oil market.

In the oil example shown below, when the RSI hit 70, it showed that the oil was overbought, and this could be considered a trading signal that the oil trend could reverse.

The oil chart then reversed the oil trend after a short while & started to move downwards, until it got to the oversold levels. This was considered a oil market bottom after which the crude oil chart started to move upwards again.

Overbought & Oversold Levels - RSI Oil Trading Strategies

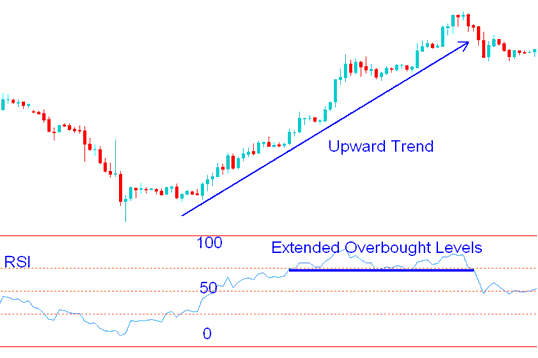

Over Extended Overbought and Oversold Levels

When the oil market is trending strongly upwards or downwards the RSI indicator will stay at these overbought and oversold levels for a long time. When this happens these overbought and oversold regions cannot be used as oil market tops and oil market bottoms because the RSI indicator will stay at these levels for an extended period of time. This is the reason why we say that the overbought and oversold regions are prone to oil whipsaws and it is best to confirm these oil signals using RSI center-line cross-over strategy.

Over Extended Overbought and Oversold Levels - RSI Oil Technical Indicator Strategy