SMA, EMA, LWMA and SMMA

There are 4 types of oil moving averages:

- Simple oil moving average

- Exponential oil moving average

- Smoothed oil moving average

- Linear weighted oil moving average

The difference between these 4 oil moving averages is the weight assigned in to the most recent crude trading price data.

SMA Technical Indicator

Oil Trading SMA indicator applies equal weight to the oil data used to calculate the simple moving average and is calculated by summing up the crude trading price periods of a oil chart and this value is then divided by the number of such crude trading price periods. For example oil simple moving average 10, adds the crude trading price data for the last 10 crude oil price periods and divides them by 10.

EMA Technical Indicator

Oil Trading EMA indicator applies more weight to the most recent crude trading price data and is calculated by assigning the latest crude trading price values more weight based on a percent P, multiplier that is used to multiply and assign more weight to the latest crude trading price data.

LWMA Technical Indicator

Oil Trading LWMA indicator moving averages applies more weight to the most recent crude trading price data and the latest data is of more value than earlier crude trading price data. Linear Weighted oil moving average is calculated by multiplying each of the oil closing crude oil prices within the series, by a certain weight coefficient.

SMMA Technical Indicator

Oil Trading SMMA Indicator is calculated by applying a smoothing factor of N, the smoothing factor is composed of N smoothing for N crude trading price periods.

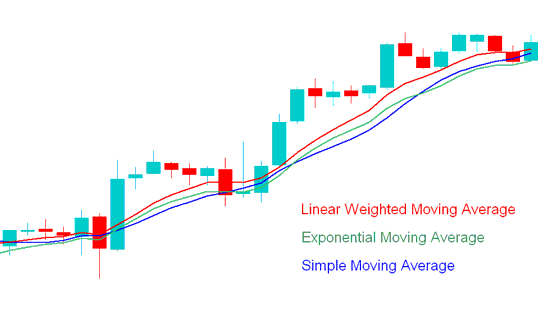

The oil chart example shown below shows SMA, EMA and LWMA. The SMMA oil moving average is not commonly used so it is not shown below.

The LWMA oil indicator reacts fastest to crude trading price data, followed by the EMA and then the SMA.

SMA, LWMA, EMA - Types of Oil Moving Averages - SMA, EMA & LWMA

Day Oil Trading with Exponential & Simple Moving Averages

The SMA and EMA oil moving averages are the most commonly used Moving averages to trade crude oil. Whereas the EMA oil moving average has a more sophisticated method of calculation, its more popular than the SMA oil moving average.

Simple Moving Average is the arithmetic mean of the closing crude trading prices in the crude trading price period based on the set time period where each time period is added and then it is divided by the number of time crude trading price periods chosen. If 10 is the crude trading price period used the crude trading price for the last ten crude oil price periods added up then it's divided by 10.

SMA oil indicator is the result of a simple arithmetic average. Very simple and some Oil traders tend to associate with the oil trend since it closely follows crude trading price action.

EMA on the other hand uses an acceleration factor and it is more responsive to the crude oil trend.

The SMA oil moving average is used in oil charts to analyze crude trading price action. If the crude trading price action in more than 3 or 4 time crude trading price periods the SMA then it's an indication that long crude oil trades should be closed immediately and the bullish momentum of the buy oil trade is waning.

The shorter the SMA crude trading price period the faster it is to respond to crude trading price change. SMA oil indicator can be used to show direct information regarding the oil trend of the oil market and the strength by looking at its slope, the steeper or more pronounced slope of the SMA is, the stronger the Oil trend.

The Exponential Moving Average is also used by many oil traders in the same way but it reacts faster to the oil market moves and therefore it is more preferred by some crude oil traders.

The SMA and EMA can also be used to generate entry and exit points when crude oil. These Moving averages can also be combined with Fibonacci and ADX indicators to generate confirmation the oil signals generated by these moving averages.