Setting A Oil Trading Schedule & a Written Examples

Oil Trading is a market that is global in nature. The global nature of the crude oil market means that it is open around the clock throughout the week. Oil traders therefore have a lot of flexibility when it comes to choosing when to trade. However, not all times are suitable for placing transactions.

Investors should set up a schedule based on the most active Oil Trading hours which are the best hours to help maximize profits.

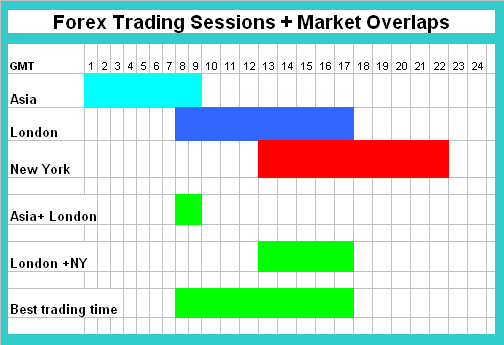

USA and London sessions are the most active times. These 3 market sessions make up the largest volumes of transactions from across the world on a daily basis, although Asia is one of these 3 sessions best not to trade during this particular session.

There are also overlaps in the between the 3 marketmarket sessions, where 2 sessions are open at the same time, these overlaps are the most active periods. These overlaps provide a great opportunity to trade in multiple markets at once & maximize your potential profits.

The best overlap is the one that occurs between the US & London markets. This is when the oil opportunities are the most active and more opportunities present themselves.

Asian session is the least active of the three major sessions. All oil instruments move slowly or consolidate at a single point throughout the session. This is not a good time to be in the oil market - this is the best time to take a break.

Because the trading day lasts all day & night & it is not possible to stay up all night long, investors should set up a workable schedule. By gaining an understanding of these hours, trader can set appropriate hours to increase chances of maximizing profits.

When setting up a schedule, it should accomplish the following goals:

1. Familiarize yourself with the various sessions. These are: New York session, the London market session, the Tokyo session.

London Session - 3 A.M. To 12 P.M. EST ( 8:00 GMT - 1700 GMT.)New York Session - 8 A.M. To 5 P.M. EST (1300 GMT - 2200 GMT.)

Tokyo Session - 7 P.M. To 4 A.M. EST (00:00 GMT - 9:00 GMT.)

2. Trade during this time when oil instruments are most active.

3. Plan a workable trading schedule. So as to keep a balance between your trading time & the time to get adequate rest. Best time is between 3a.m. To 5p.m. EST

When the USA and UK sessions are both open crude oil prices will generally trend up or down and move a good number of pips in one direction. As a technical analyst, this time the indicators will provide good & profitable signals that catch the trend.

When the crude oil prices are trending & moving fast traders will find it much easier to make money.

On the other hand, during the other times for example the Asian session, the crude trading prices will be in a range movement and traders using technical indicators will have a hard time making profits as the indicators will generally tend to be more prone to whipsaws. One will find it difficult to make money in this range bound crude oil price action movements.

It is 10 times easier to make money when the oil market is moving up or moving down than it is to make money when it is ranging.

During the best times to open orders, i.e. 800 GMT and 1800 GMT the crude trading prices will oil trend in one direction, during other times like Asian Session, the crude oil prices likely to be Range Bound.

- London session 08:00 GMT -16:00 GMT.

- US market session 13:00 GMT - 22:00 GMT.

- Asian session is a relatively slow for all oil instruments & not suitable at all.

Basically your plan should target 800 GMT and 1800 GMT as the time that you trade oil trading instruments.

Example of a Schedule on a Oil Trading Plan

The example shown below shows how to specify your routine and time of day to watch the crude oil market. This will form the basis of your schedule. The time frame that you use will also be specified and mostly it will depend on what type of trader you are. The time set for this example is during the day when the UK and USA sessions are open as shown on the oil example shown below.

Written Oil Trading Schedule - Oil Trading Plan Sections