Crude Trading Market Hours and The 3 Major Oil Trading Sessions

Tokyo Close Charts

To maximize the number of trading opportunities during these Oil Trading hours, it is important to be aware of the times when the oil market is busiest. This is the time that most oil transaction activity occurs.

Even though there is no official open & close time during the week, it can be broken up into 3 major Oil Trading sessions - Tokyo, London and New York sessions.

However, although it seems not to be very important at the start, the right time to trade is one of most crucial points required to be a successful investor.

The best time is when the oil market is most active and therefore has the biggest volume of transactions. A more active market creates a good chance to make some profit while a calm and slow one is literally a waste of time - turn off your computer and don't even bother trading oil at this time.

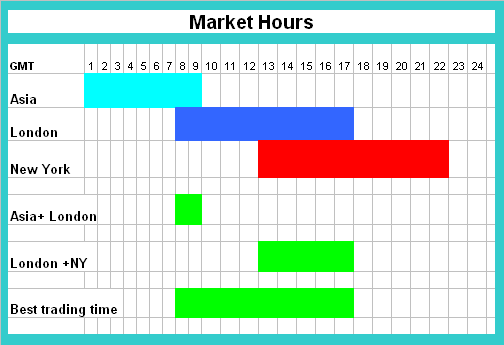

Not all the times are suitable, that is because the volatility keeps changing. Below is a table outlining the schedule of Oil Sessions. The time used is GMT 0

The 3 major sessions are:

- Asian Market Session Hours( Tokyo ): 00:00 - 9:00 GMT

- European Market Session Hours( London ): 7:00 - 17:00 GMT

- U.S. Session Hours( New York ): 13:00 - 22:00 GMT

Best Oil Trading Times

There are hours when two market sessions are overlapped:

London + Tokyo overlap - 7:00 - 9:00 GMT

New York + London overlap - 13:00 - 17:00 GMT

At these overlapping market hours you'll find the highest volume of oil transactions and therefore more chances to win during these hours.

This means that the lion share of oil transactions is happening between the London session and US sessions. Naturally this is the best time to make profits.

The crude oil prices moves a lot during the New York & London Sessions because Multinational companies, hedge funds, managed funds and banks are open for transacting.

Multinationals will transact oil instruments during this time to facilitate international business transactions and commerce, hedge funds and managed funds will trade oil instruments for investment purposes, banks on the other hand will exchange a lot of money on behalf of their clients, maybe tourists wanting to travel around the globe or just anyone wanting to exchange money so as to buy something in another country or make some transaction.

This makes the oil market very liquid at this time and the high volume of transactions means that crude trading prices move a lot. At this time the crude oil charts will generally move in particular direction and form a short term trend.

As a trader you also want to join in when everyone is placing their oil orders as this is the time there is enough liquidity and many good opportunities to make money, and because there is a lot of liquidity the crude trading price movement will generally be more predictable unlike when there is little liquidity and the crude trading price movement becomes unpredictable and the crude oil prices can move in a range bound with no particular direction.

Once you trade oil trading for a while you will get to know that is easier to make money when the oil market is moving up or moving down, unlike when it is in a range.

Asian Session Characteristics:

- Least volatile of the 3 market sessions

- Account for 15% of daily transaction turnover

- Typical 20 -30 pip moves

European Session Characteristics:

- Most volatile of the 3 market sessions

- 35% of daily transaction volume

- Typical 90 -150 pip moves

US Session Characteristics:

- 2nd most volatile of the 3 market sessions

- Accounts for 25 % of daily turnover

- Focuses on US economic news

US and Europe Session Overlaps Characteristics:

- Combines the 2 most volatile trading sessions

- Accounts for 60% of total daily transaction turnover

- Focuses on USA & European economic news

- Fast moving crude trading prices and oil instrument trends in a particular direction

- Typical 100 -150 pip moves for major crude trading instruments