What is the Meaning of Fibonacci Retracement?

How Do You Interpret Fibonacci Retracement?

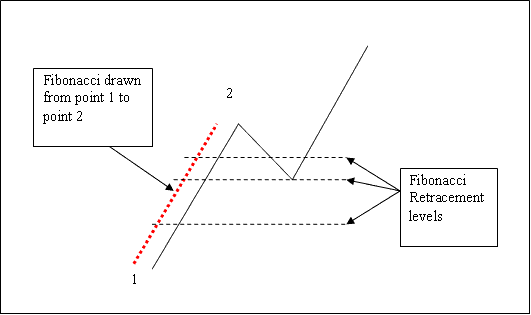

Fibonacci Retracement is an indicator used in gold trading to calculate xauusd price retracement levels in an upward or a downward xauusd trend. These retracement levels are then used by traders to place xauusd trades & open trades at a better price after xauusd price has retraced and resumes moving in the original gold trend direction.

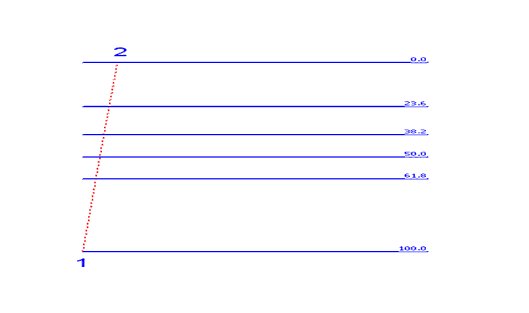

What's the Explanation Fibonacci Retracement Levels?

- 23.6% Gold Trading Fibonacci Retracement

- 38.2% Gold Trading Fibonacci Retracement

- 50.0% Gold Trading Fibonacci Retracement

- 61.8% Fibonacci Retracement

How Do You Interpret Gold Trading Fibo Retracement Levels?

38.2% and 50.0% Fibonacci Retracement Levels are most used and most of the time this is where the price retracement will reach. With 38.2% Fibo Retracement Level being the most popular & most widely used retracement level in gold trading.

61.8% Fibonacci Retracement Level is also commonly used to set stop losses for trades opened using this gold trading retracement strategy.

Fibonacci Retracement Levels indicator is plotted in direction of the trend as displayed in the two example below.

What's the Explanation of Fibo Retracement?

What's the Explanation of Fibo Retracement?

What is the Definition Fibonacci Retracement Levels?

What is the Definition Fibonacci Retracement Levels?