Definition of Reversal Chart Setups

Reversal Setups confirm the reversal of the market trend once this reversal setup is confirmed.

The reversal patterns are formed after extended market trend either upwards or downwards & these reversal chart patterns signal that the market trend is about to reverse.

1. Reversal Patterns

- Double Tops Reversal Chart Setups

- Double Bottom Reversal Setups

- Head and Shoulders Reversal Chart Setups

- Reverse Head and Shoulders Reversal Chart Setups

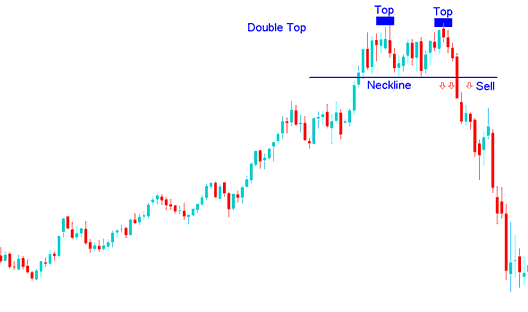

Double Tops

Double tops pattern is a reversal setup that's formed after an extended up-ward trend. As its name implies, this pattern is made up of two consecutive peaks that are roughly equal, with a moderate trough in between.

Summary:

- Double tops chart pattern forms after an extended move upwards

- Double tops pattern formation demonstrates that there will be a reversal in the market

- We sell when price breaks out below neck line point: see below for an explanation.

Example of Double Tops Reversal Chart Pattern on a Chart

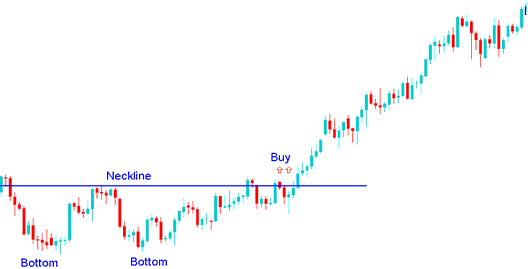

Double Bottoms

Double bottoms pattern is a reversal setup that's formed after an extended downwards trend. It is made up of 2 consecutive troughs that are roughly equal, with a moderate peak in between.

Summary:

- Double bottom chart pattern forms after an extended move downward

- Double bottoms pattern formation demonstrates that there will be a reversal in the market

- We buy when price breaks out above neck-line point: see below for an explanation.

Example of Double Bottoms Reversal Chart Pattern on a Chart

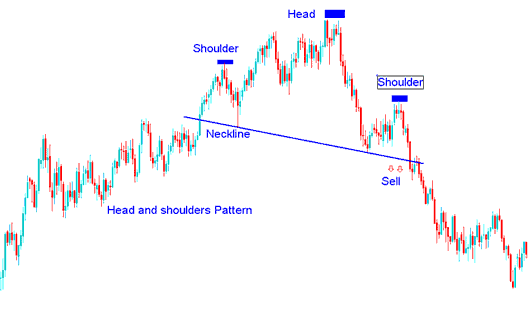

Head and Shoulders Chart Setup

Head & Shoulders setup is a reversal setup which forms after an extended Gold Trading upward trend. It is made up of 3 consecutive peaks, the left shoulder, the head & the right shoulder with two moderate troughs between the shoulders.

Summary:

- Head & Shoulders pattern forms after an extended move upward

- Head & Shoulders setup formation demonstrates that there will be a reversal in the market

- Head & Shoulders trading pattern formation resembles head with shoulders thus its name.

- To draw the neck-line we use chart point 1 and point 2 as shown below. We also extend this line in both directions.

- We sell when price breaks out below the neck-line point: see the chart below for explanation.

Example of Head & Shoulders Reversal Chart Pattern on a Chart

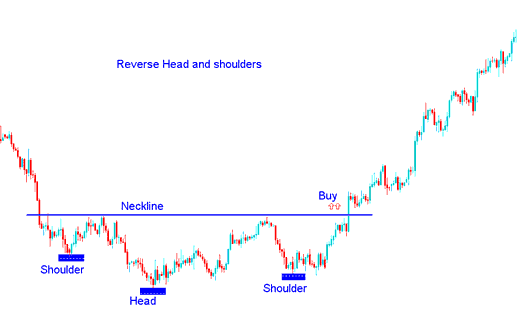

Reverse Head and Shoulders Chart Setup

Reverse Head and Shoulders setup is a reversal head & shoulders chart setup which forms after an extended Gold Trading downward trend. It resembles an upside-down head shoulders.

Summary:

- Reverse Head & Shoulders pattern forms after an extended move downward

- Reverse Head and Shoulders setup formation demonstrates that there will be a reversal in the market

- Reverse Head and Shoulders pattern formation resembles upside-down, thus the name Reverse.

- We buy when the price breaks-out above neck line point: see the chart below for explanation.

Example of Reverse Head & Shoulders Reversal Pattern on a Chart

Reversal Chart Setups Lessons

Double Tops Chart Patterns & Double Bottom Chart Setups

Head & shoulders Chart Setups and Reverse Head & Shoulders Chart Setups