What is a Trend Reversal?

Definition of a Trend Reversal and the Appropriate Methodology for Trading Such Events

In trading the trend line break signal is used to signify a market reversal setup. When a trendline is broken then it means the force of the current trend is reducing/decreasing & the current trend might reverse & start moving in the opposite market direction or form a consolidation chart pattern before it reverses.

Market Reversal Signal

After the price has moved consistently in one direction for an extended duration within a trend, it eventually reaches a point where its forward movement within that trend ceases. We label this occurrence as a trend line break.

When a trend line acts as a point of support or resistance and the market shifts direction upon encountering this level, traders often close out their open positions. This process of exiting trades is referred to as taking or booking profits.

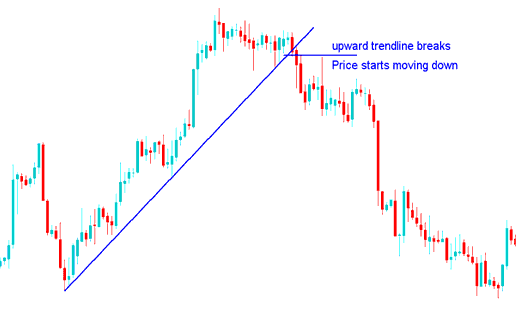

Up trend Reversal

Price breakouts from an uptrend support line may lead to downward movement or consolidation before continuing downward.

Understanding Upward Trend Reversal in Gold Trades and Its Basics

Confirmation of a shift away from an upward trend, signaled by the breaking of that ascending line, is established when a lower high price formation materializes on the chart. This break concurrently opens the door for taking a short position.

Trading Market Reversal Signal

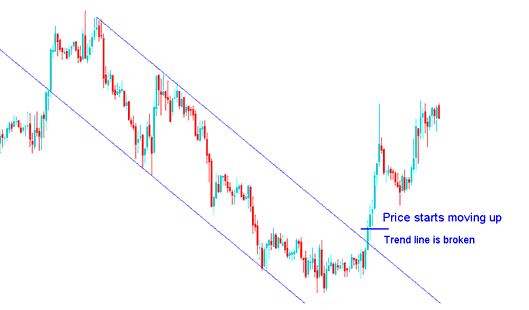

If the price goes below the downward trendline (resistance), the market will then go up or create a pattern of staying in a range before going up.

What is Downward Trend Reversal in Gold Trading?

Confirmation for this downward trend-line break reversal signal is established when a subsequent higher low is formed. This condition simultaneously presents a trading chance to enter a long position following the breach of the descending trend line.

NB: Sometimes when the price breaks its trend it might first of all consolidate before going in the opposite trend direction. Either way it is always good to take profit when the trend direction reverses.

To execute this trend reversal setup successfully, upon opening a new trade aligned with the forecasted reversal direction, the price should immediately follow suit, entering a breakout phase. This implies the market should quickly move in the anticipated direction without encountering significant market resistance.

Conversely, if the market does not immediately move in the direction of the breakout, it's advisable to exit the trade as it suggests that the current trend remains intact.

Another tip: wait for the trend line to break and for the market to close above or below it. That way, you'll know the trend really has reversed.

What happens is most traders open trades waiting for reversal setup even before the ruling trend is broken, only for the price to touch this trendline & for the current market trend direction to hold & gold to continue with the current market direction.

When using this trend reversal setup, it is advisable to wait for confirmation of a price breakout by observing whether the price closes above or below the trend line, aligning with the market direction.

- Up-wards Gold Trade Market Direction Reversal - trendline reversal signal gets confirmed once the market closes below this upward trend line, this should be the right time to open a sell trade, so as to avoid a trade fake-out.

- Downwards Gold Trade Market Direction Reversal - trendline reversal signal gets confirmed once the market closes above the downward trend line, this should be the right time to open a buy trade, so as to avoid a trade whipsaw fakeout.

More Tutorials & Courses:

- Desktop Gold Software, WebTrader XAUUSD Software & Mobile Gold Software

- Tutorial for the No Nonsense Gold ADX Indicator Course

- Process for Merging Gold Indicators to Formulate a Coherent Gold Trading Methodology?

- Conducting Multiple Timeframe Analyses of XAUUSD Charts

- Looking at the Demarker Gold Indicator

- How do I know when a new XAUUSD trend is starting?

- Lesson: Price Action Strategies Explained

- What is the Key Difference Between MT4 Software & MT5 Platform?