Commodity Channel Index (CCI) Forex Trading Technical Analysis & CCI Signals

Developed by Donald Lambert

Commodity Channel Index measures the variation of a commodity price from its statistical mean/statistical average.

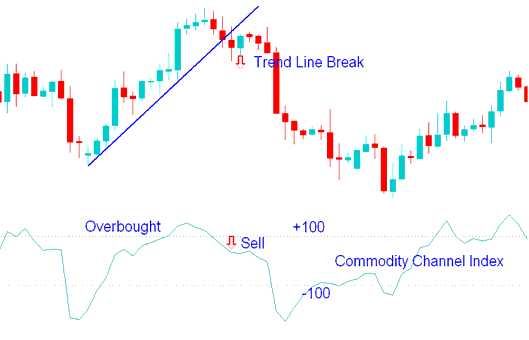

This indicator is an oscillator which oscillates between high levels & low levels

When the CCI is high it shows that price is unusually high compared to the its average.

When the CCI is low it shows that price is unusually low compared to the its average.

Forex Trading Analysis and Generating Signals

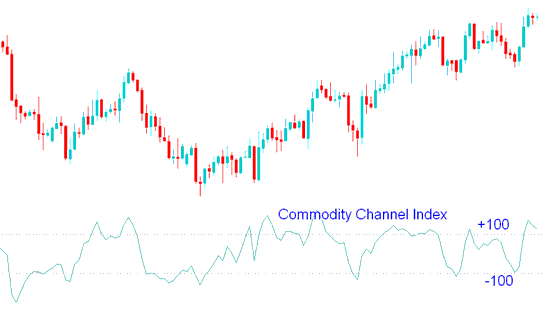

Overbought/ Oversold Levels

The CCI typically oscillates between ±100.

Indicator values above +100 indicate an overbought conditions & an impending market correction.

Indicator values below -100 indicate an oversold conditions & an impending market correction

Buy Trading Signal

If the Commodity Channel Index indicator is oversold, areas below -100, then there is a pending market correction.

Oversold levels will remain intact until Commodity Channel Index technical indicator starts to move above -100.

When price starts moving above -100 then that is interpreted as a buy.

The Commodity Channel buy signal should be combined with a trendline break signal to confirm the buy.

Buy Trade

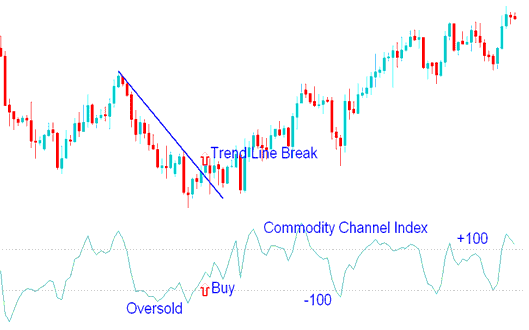

Sell Signal

If the Commodity Channel Index is over bought, levels above +100, then there's a pending market correction.

The overbought areas will remain intact until Commodities Channel Index indicator starts to move below +100.

When price starts moving below +100 then that is a interpreted as sell.

This Commodity Channel sell signal should be combined with a trendline break signal to confirm the sell.

CCI Trading Indicator Sell Signal

FX Trading Divergence Forex Trading

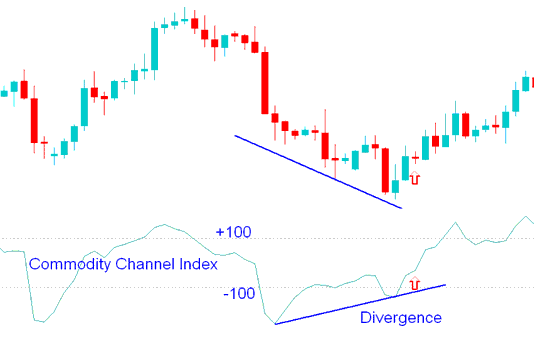

Bullish FX Trading Divergence Setup

Bullish divergence occurs when the price is making new lows while the Commodities Channel Index technical indicator is failing to surpass its previous low.

This is a bullish trading signal because the divergence will be followed by an upwards market correction.

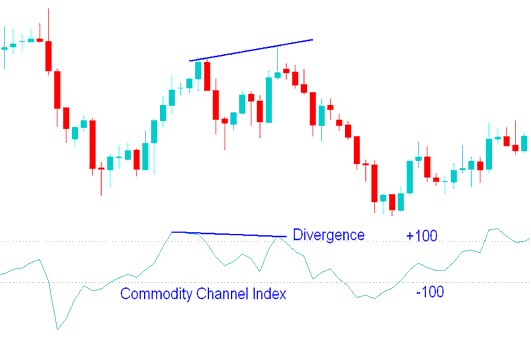

Bearish Forex Trading Divergence Setup

Bearish Divergence forms when the price is making new highs while the CCI technical indicator is failing to surpass its previous high.

This is a bearish trading signal because the divergence will be followed by a downwards market correction.

Technical Analysis in Forex Trading