McClellan Histogram Trading Technical Analysis & McClellan Histogram Signals

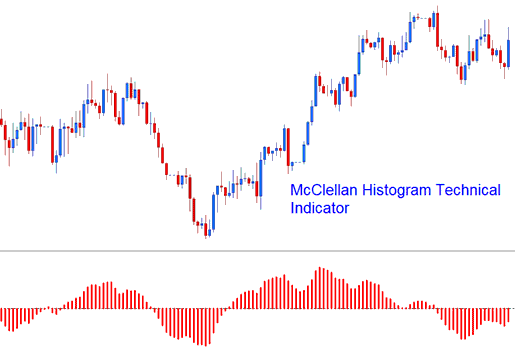

The McClellan Histogram is a graphical representation of the McClellan Oscillator and its signal line. This difference between the two is plotted as a histogram.

This is an oscillator, the center line is the zero cross-over mark which is used to generate buy and sell signals.

McClellan Histogram

Trading Technical Analysis and How to Generate Signals

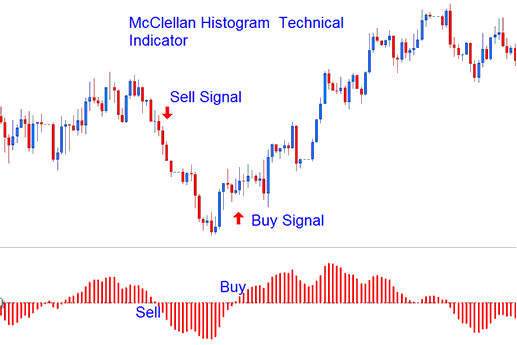

The Histogram is momentum indicator. Signals are generated using the center-line cross over method.

- Bullish signal- Above Zero

- Bearish Signal - Below Zero

There are two fundamental techniques for using this indicator to generate trading signals.

Zero-Level Crossover- When the histogram crosses above the zero a buy signal is generated. Otherwise, when the histogram oscillator crosses below the zero a sell signal is generated.

Technical Analysis in Forex Trading

Divergence Trading - divergence trading between this indicator and the price chart can prove to be very effective Forex strategy in spotting potential trend reversal signals and trend continuation signals.

There are several types of FX Trade Divergence Trading Signals:

Trend Reversal Signals - Classic Divergence Signals

- Classic Bullish Divergence Signals - Lower lows on price chart and higher lows in the McClellan Histogram

- Classic Bearish Divergence Signals - Higher highs on price chart and lower highs in the McClellan Histogram

Trend Continuation Signals - Hidden Divergence Signal

- Hidden Bullish Divergence Signals- Lower lows in McClellan Histogram and higher lows in price chart

- Hidden Bearish Divergence Signals- Higher highs in McClellan Histogram and lower highs in price chart

To Learn more about divergence go to the divergence trading topic on this website