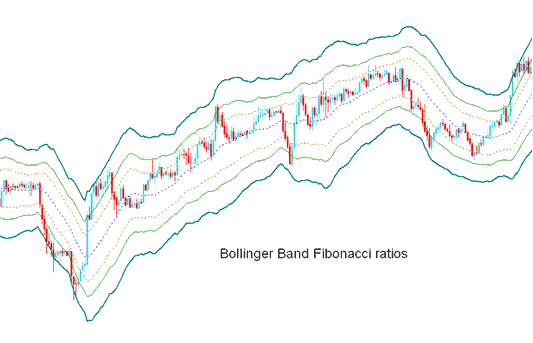

Bollinger Bands - Fibonacci Ratios Forex Trading Technical Analysis & Signals

Derived from the original Bollinger bands.

The Bollinger Fib ratios is a volatility based indicators but it does not use the standard deviation to calculate the width of the bands instead it uses a smoothed ATR that are multiplied with Fibonacci ratios of 1.618, 2.618, & 4.236.

The smoothed lines that are multiplied with Fibonacci ratios are then added or subtracted from the moving average.

This forms Three upper Fibo bands & 3 lower Fibo bands

The middle band forms the basis of the trend.

Forex Trading Technical Analysis & How to Generate Trading Signals

This indicator used to determine point of support and resistance for a currency pair.

The lines below represent support points while those above are resistance zones.

Outermost bands provide the strongest resistance/support.

Inner most bands provide least support/resistance.

The innermost band represents Fibo 38.2% retracement level

The second band represents Fib 50% retracement level

The outermost band represents Fib 61.8% retracement level

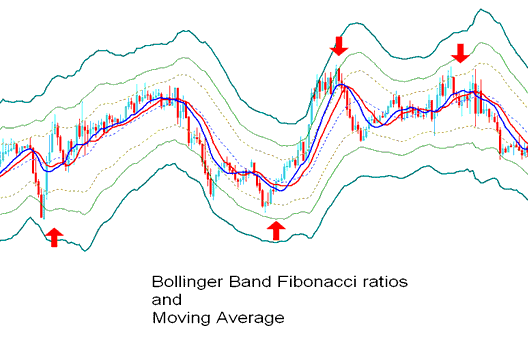

The Indicator is used to determine points where price might reverse. (Price Pullback Levels)

When price hits one of the lines & reverses then an entry or exit signal is generated.

However, it's always good to combine the signal with other confirmation indicators such as the moving average to confirm the signal as displayed below.

Technical Analysis in FX Trading