What is Swap in Oil?

In Oil, there is the payment of swaps every day: this is the interest rate of a oil that the oil instrument earns per day. This interest for a oil instrument like the Australian Dollar is 5%, this means that every day a fraction of this five percent is paid to anyone holding this Australian Dollar.

This brings the Issue of paying & getting paid interest which is an Issue in the Islamic Religion. Islamic Religion doesn't allow paying & getting paid an interest payment, For Islamic oil traders there's a account designed in accordance with their Values: Known as Swap Free.

For this oil account a trader will not pay the overnight rollover interest on any crude oil and will also net get paid any interest, this is also known Shariah Compliant where there is no paying of RIBA (interest) - also referred to as Islamic Accounts.

For a trader to get a swap free account, a trader has to go to a oil Islamic oil broker and select the option of "Islamic Account", This option is provided under the Accounts Section of the broker specifying instructions of opening one of these accounts.

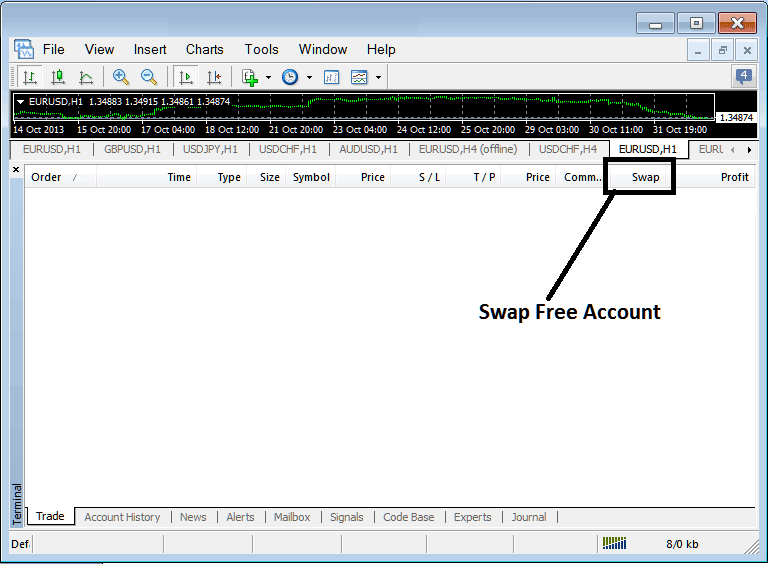

Once a trader opens a this oil account, then the Oil Trading rollover interest is removed. Once this no paying of interests is set, if a trader is using a platform such as MetaTrader 4 then the rollover fee record will be set to zero.

The rollover fee is charged daily at the end of the trading day for those holding a particular oil instrument for which a swap is to be applied. As a trader if you do not want to pay this rollover you should close your trades before the end of the day, that way you will not pay the rollover fee as you are no longer holding open oil trade. Because the oil market does not open on Saturday and Sunday, the rollover for these 2 day will be charged on Wednesdays, meaning on Wednesday one will pay the rollover for Wednesday, Saturday & Sunday, and therefore on Wednesdays this rollover fee is paid 3 Times.

These positions that pay a rollover interest are commonly known by traders as Overnight Trade Positions. Day Traders rarely leave their trade transations opened overnight & close them all before the end of the day. Swing Traders on other hand might leave their trade transations opened for a few days and leave these trades overnight in order to capture more movement in crude trading price trend.

Once a trader finds a swap free oil broker and opens and Islamic Account, the trader will have the same trading conditions as those of other traders, except for the paying of rollover fees. This means a trader will use the MetaTrader 4 Oil Trading Platform like all the other traders, the trader can trade all currencies, all indices, all CFDs, all metals and all other Financial Instruments provided by the oil Islamic broker.

However, be careful in selecting a swap free broker, some brokers will add a commission or add some pips to the spread you trade with to cover the swap(Swap Fee Broker). This isn't supposed to happen as the trader will still be paying for the interest even though is disguised as another charge, good oil Brokers do not add any commission nor do they add any charge onto the spreads.

Another thing is that some online brokers will charge a rollover fee (swap fee) if the position held by a trader is held for more than 5 days or more than 7 days, this should not be the case and the broker should not charge any carryover interest even if open trades are held for more than five or seven days. For traders wanting to open this swap free account with a oil Islamic oil broker it's good to check for any additional terms of trading for the Islamic Account that you're going to be opening to make sure that the broker you select is really a no swap broker.

Islamic Oil Trading Account

Swap free accounts were introduced by online brokers after demand for carry over interest free trading accounts grew among the Islamic oil traders. Traditional account entailed paying of rollover interests in what is known as rollover interest. This led to the introduction of Interest Free Accounts that Islamic traders could open & still keep in line with their rules on no paying & getting paid interest.