Short Term Moving Averages Gold Trading Strategies

Moving Averages XAUUSD Trading Systems

Short term gold trading will use short xauusd price periods like the 10 and 20 moving average price periods.

In the xauusd trading example illustrated and explained below we use 10 and 20 Simple Moving Average to generate Gold signals: the gold signals generated are able to identify the gold trend as early as possible.

Short-term Gold Trading with Moving Averages - How to Trade Gold with Moving Averages Example

Using Moving Averages

One of the most widely used methods of technical analysis that is used to analyze gold chart trends in scalping is the use of moving average indicator.

The idea behind this moving average gold indicator is to simply enhance technical analysis before taking a gold signal to enter the xauusd market. Planning and setting gold trading goals in the short term according to moving averages helps a scalper gold trader to identify trends in the xauusd market and thus open a gold order accordingly.

Most of the gold signals can be established using a specific xauusd price period for the Moving Average Gold Technical Indicator. The gold trading Moving average indicator determines whether the trader will trade in the short term or long-term. In addition, the xauusd price action is above or below this moving average indicator it determines the gold trend of the xauusd market for the day.

If a large part of the gold market xauusd price is considered to be below the Moving average indicator, then bias gold trend for the day is downwards. Most traders they use the Moving Average Technical Indicator as support or resistance to determine where to open a gold trade position, if xauusd price touches the Moving Average in the direction of the gold market trend a gold trade is then opened.

The gold trading moving averages are drawn and the intersection point with the xauusd price can be used to determine the appropriate entry and exit times in the gold trading market. Since there is always oscillation in the xauusd market trends and the xauusd market will repeat this process of oscillating and bouncing off the Moving Average and this can be used to generate buy or sell signals.

Simple moving averages are calculated and their approach is based on the observation of the xauusd price within a particular period of time using sufficient data to calculate it. Their interpretation has provided many gold trading scalpers with lots of tips on how and when to open gold trading scalping trading.

Medium Term Strategy

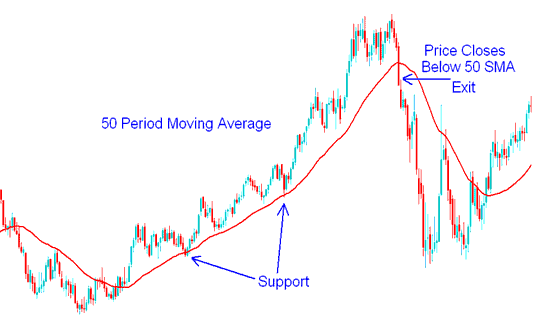

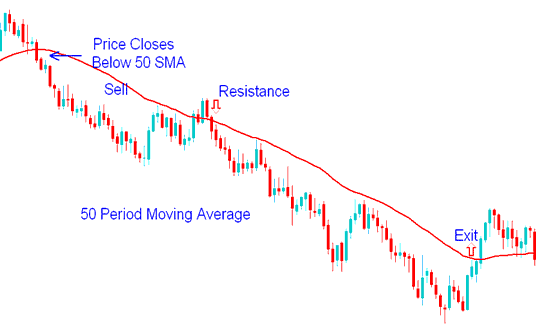

Medium term gold trading moving average trading strategy will use the 50 period Moving Average.

The 50 period Moving Average acts as support or resistance level for the xauusd price.

In an upward gold trend the 50 period Moving Average will act as a support, xauusd price should always bounce back up after touching the Moving Average. If the xauusd market closes below the indicator then this will be an exit signal.

50 Moving Average Period Support - Gold Trading Strategy Examples

In a down gold trend the 50 period Moving Average will act as a resistance, xauusd price should always go down after touching the moving average. If the xauusd market closes above this technical indicator then this is an exit signal.

50 Moving Average Period Resistance - Gold Trading Strategies Examples

50 Day Moving Average Gold Trading Analysis

As the gold trend moves upwards, there is a key line you want to watch - this is the 50 day gold trading moving average. If the xauusd market stays above this 50 day gold trading moving average, that is a good signal. If the xauusd market drops below the 50 day gold trading moving average in heavy volume, watch out, there could be gold trend reversal signal ahead.

A 50 day MA gold indicator takes 10 weeks of gold market data, & then plots the average. Moving line is recalculated everyday. This will show the gold trend - it can be up, down, or sideways.

You normally should only buy when prices are above their 50 day gold trading Moving Average. This tells you the current gold market direction is trending upward. You always want to trade with the gold trend, and not against it. Many gold traders only open orders in the direction of the trend.

Xauusd prices normally will find support over and over again at this 50 day gold trading moving average. Big investing institutions watch this level closely. When these big volume entities spot a gold trend moving down to its 50 day line, they see it as an opportunity, to add to their trade position, or start a new gold trade position at a reasonable level.

What does it mean if xauusd price moves downward and slices through its 50 day line. If it happens on heavy volume, it is a strong gold signal to sell. This means big institutions are selling their share, and that can cause a dramatic drop, even if fundamentals still look solid. Now, if xauusd price drops slightly below the 50 day line on light volume, watch how it acts in the following days, and take appropriate action if necessary.

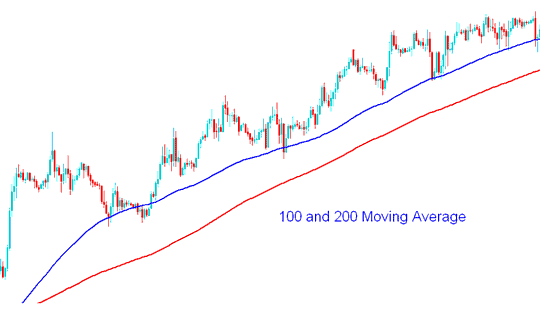

Long Term Strategy

Long term gold trading strategy will use long period such as the 100 and 200 MAs which act as long term support and resistance levels for the price. Since many traders use these 100 and 200 gold trading moving averages, the xauusd price will often react to these support and resistance levels.

100 & 200 MAs - How to Trade Gold Using Moving Average Gold Trading Strategies

In Gold, traders can use both fundamental analysis and technical analysis to help determine whether gold is a good buy or sell.

In xauusd trading analysis technique, gold traders looking to gauge supply and demand for gold use the 200 day moving average to examine data in different ways.

Traders are most familiar with the basic xauusd trading analysis of the 200 day Moving Average which is used to draw the long term support or resistance level. If xauusd price is above 200 day Moving Average then the trend is bullish, and if it is below it then gold trend is bearish.

One of the ways to measure supply and demand in gold trading is to calculate the average closing xauusd price over the last 200 sessions. This xauusd trading moving average accounts for each day going back in time & shows you how this 200 day average has moved.

The reason why the average 200 day Moving Average in particular is so popular in xauusd analysis is because historically has been used and it produces good results for trading in the gold trading market. A popular timing gold trading strategy is used to buy when the xauusd market is above its moving average of 200 days and sell when it goes below it.

With this moving average gold indicator, xauusd traders can benefit from being notified when price rises above, or falls below its 200 day Moving Average and then traders can then use their technical analysis to help determine if the gold signal is an opportunity to go long or short.