SMA, Exponential Moving Average, Linear Weighted MA & SMMA

There are four varieties of trading moving averages.

- Simple gold MA

- Exponential gold trading MA

- Smoothed gold MA

- Linear weighted gold trading MA

The distinction among these four gold moving averages lies in the emphasis given to the most recent price data points.

SMA Trading Indicator

The gold simple moving average tool gives equal weight to all data points. It adds up the prices over set periods on a chart. Then it divides that total by the number of periods. Take a 10-period simple moving average as an example. It sums the last 10 prices and splits by 10.

EMA Indicator

The Moving Average indicator gives more importance to recent price data. It does this by giving recent price values more weight using a multiplier that gives more weight to the latest data.

LWMA Indicator

The Gold Linear Weighted Moving Average gives more weight to recent prices. New data matters more than old data. It works by multiplying each closing price in the series by a weight factor.

SMMA Trading Indicator

The Gold SMMA Indicator is determined by applying a smoothing factor of N, which consists of N smoothing periods for historical price data.

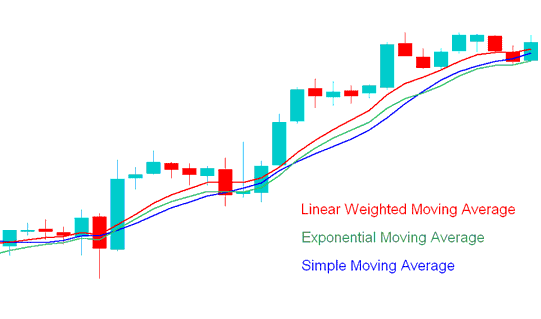

The chart example provided highlights three types of Moving Averages: Simple MA, Exponential MA, and Linear Weighted MA. The SMMA gold moving average isn't frequently applied and is omitted from this example.

The Linear Weighted Moving Average indicator is quickest to respond to price data, followed by the Exponential Moving Average and then the SMA.

Types of moving averages include SMA, Linear Weighted MA, and Exponential Moving Average. These cover Simple Moving Average, Exponential Moving Average, and LWMA.

Intraday Trading with Exponential and Simple Moving Averages

The Simple Moving Average (SMA) and the Exponential Moving Average (EMA) are the two most frequently employed moving averages for trading gold. Despite the EMA utilizing a more complex calculation methodology, it enjoys greater popularity among traders compared to the Simple Moving Average for gold trading analysis.

A Simple Moving Average (SMA) is calculated as the average of the closing prices over a specified price timeframe: this involves summing the prices for each period in the set timeframe and then dividing by the quantity of price periods selected. For instance, if a price period of 10 is used, the sum of the prices from the preceding ten periods is divided by 10.

The SMA indicator comes from a basic math average. It's straightforward, and many traders link it to trends because it tracks prices closely.

Conversely, the Exponential Moving Average (EMA) incorporates an acceleration factor, making it react more swiftly to contemporary price movements.

The Simple Moving Average gold trading moving average is used in charts to analyze and interpret price action. If the price action in more than 3 or 4 time price periods the Simple Moving Average then it's an indication that long trades should be closed immediately and the bullish momentum of the buy trade is waning.

The responsiveness of the Simple Moving Average (SMA) to price changes increases as the price period decreases. The Simple Moving Average indicator can provide direct insights into the price trend and its strength by analyzing its slope: a steeper or more pronounced slope of the SMA indicates a stronger market trend.

Many traders also use the Exponential Moving Average in a similar way, but it responds more quickly to market changes, so some traders like it better.

The Simple Moving Average and Exponential Moving Average can also help you find good times to buy or sell when trading gold. You can also use these averages with Fibonacci and ADX tools to be more sure about the trading signals these moving averages show.

Obtain Further Programs & Instructional Material:

- Bollinger Bands Bulge & Bollinger Bands Squeeze XAUUSD Analysis

- How Can I Add Quotes to MT4 Platform Software?

- DeMarks Range Extension Index Gold Indicator

- How Do I Trade an Upwards XAUUSD Trend on a Trading XAUUSD Chart?

- How to Set Demarker on Gold Chart in MT4 Platform Software

- How Can I Add Quotes to MT4 Platform Software?

- Types of XAUUSD Analysis

- How Do I Draw MetaTrader 4 Channel Trading Indicator?

- How to Analyze/Interpret Fibo Extension Settings in MT4 Platform Software

- How Can I use MetaTrader 4 XAUUSD Demo Account?