Technical Analysis Using Bollinger Bands Volatility Indicator

The Gold Bollinger Bands Volatility Indicator are self adjusting which means the Bollinger bands widen and narrow depending on xauusd price volatility.

Standard Deviation is the statistical measure of xauusd price volatility that is used to calculate the widening of the gold Bollinger bands or narrowing of the gold Bollinger bands. Standard deviation will be higher when the prices are changing significantly and Standard deviation will be lower when the gold market prices are not changing a lot.

- When the xauusd price volatility is high the Bollinger Bands widen - Bollinger Bands Break out Trading Strategy.

- When gold the xauusd price volatility is low the Bollinger Bands narrows - Bollinger Bands Consolidation Trading Strategy.

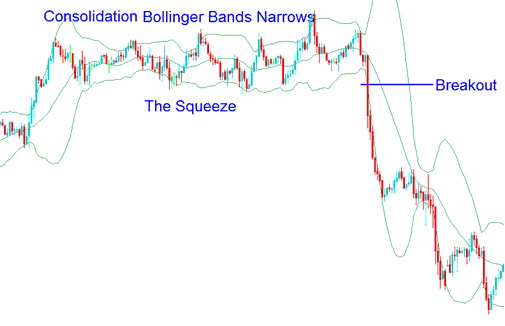

Bollinger Bands Consolidation Trading Strategy

Narrowing of the gold Bollinger Bands is a sign of xauusd price consolidation and is known as the Bollinger Bands Squeeze.

When the Bollinger Bands indicator display narrow standard deviation it is usually a time of xauusd price consolidation, and this is also a gold signal that there will be a xauusd price breakout and it shows that gold traders are adjusting their gold trade positions for a new gold trend move. Also, the longer the xauusd prices stay within the narrow Bollinger Bands range the greater the chance of a xauusd price breakout.

Bollinger Bands Squeeze - Bollinger Bands Break-out Strategy - Bollinger Bands Consolidation Trading Strategy

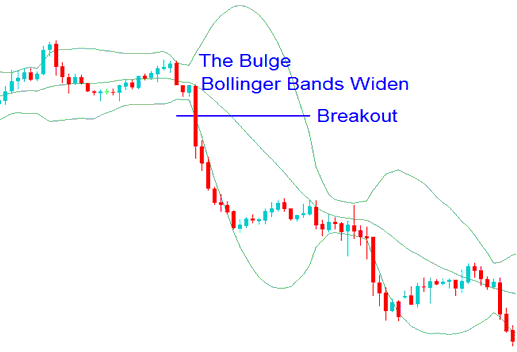

Gold Trading Bollinger Band Volatility Break out

Widening of Bollinger Band technical indicator is a sign of a xauusd price break out & this is known as Bollinger Band Bulge.

Bollinger Bands indicator that are far apart can be interpreted as a gold signal that a gold trend reversal is likely to happen. In the Bollinger Bands indicator xauusd trading example illustrated and explained below, the gold Bollinger Bands get very wide as a result of high xauusd market price volatility. The gold trend reverses as xauusd prices reach an extreme level according to statistics and the theory of normal distribution. The "Bollinger Bands Bulge" predicts the change of the trend to a xauusd trading downwards trading trend.

Bollinger Bands Bulge - Bollinger Bands Volatility Breakout - Bollinger Bands Breakout Trading Strategy

Bollinger Bands Volatility Gold Break out - Gold Trading Analysis Using Bollinger Bands Volatility XAUUSD Indicator - Bollinger Bands Breakout Gold Strategy - Bollinger Bands Consolidation Trading Strategy