Energies Leverage Examples & Margin Trading Example and Examples

Margin required : It is the amount of money your energies broker requires from you to open a position. It is expressed in percentages.

Equity : It's the total amount of capital you have in your account.

Used margin : amount of money in your account which has already been used up when buying a energies contract, this contract is the one that is displayed in open trades. As a trader you cannot use this amount of money after opening a trade because you have already used it & it is not available to you.

In other words, because your energies broker has opened up a position for you using the capital you have borrowed, you must maintain this usable margin for your trading account as a security to allow you to continue using this energies trading Leverage Example he has given you.

Free margin : amount in your account which you can use to open new trade positions. This is the amount of money in your account which has not yet been energies trading Leverage Exampled because you have not yet opened a transaction with this money - this is also very important for you as a investor because it enables you to continue holding your open trades as will be explained below.

However, if you over use energies trading Leverage Example, this free margin will drop below a certain percent at which your energies broker will have to close all your positions automatically, leaving you with a big loss. The energy broker at this point will automatically close all your open trades because if your open trade positions are left open then your broker would lose the money that you would have borrowed from them.

This is why you should always make sure you've a lot of free margin. To do this never trade more than 5 percent of your energies trading account, in fact 2 percent is recommended.

Difference Between Energies Trading Leverage Example Set by the Broker and Used Energies Trading Leverage Example

If the set energies trading Leverage Example is 100: 1, it means you can borrow up to 100 dollars for every 1 dollar that you have, but you don't have to borrow all of the 100 dollars for every dollar you've, but you can decide to borrow 50:1 or 20:1. In this case even though the leverage ratio option set 100:1 your used energies trading Leverage Example will be the 50:1 or 20:1 that you have borrowed to make a trade.

Example:

You have 1000 dollars (Equity)

Set 100:1

Energies Trading Leverage Example Used = Amount used /Equity

If you buy energy lots equal to 100,000 dollars you will have used

= 100,000/1000

= 100:1

If you buy energies trading lots equal to 50,000 dollars that as a trader you will have used

= 50,000/1000

= 50:1

If you buy energies lots equal to 20,000 dollars you will have used

= 20,000/1000

= 20:1

In these three cases you can see that even though the set is 100:1

The used is 100:1, 50:1, 20:1 depending on the size of energies lots traded.

So Why not Just Choose 10:1 option as the Maximum Energies Trading Leverage Example? Because to keep within the proper risk management rules it is even recommended that traders use less than this?

This question may seem straight forward but it's not, because when you trade you use borrowed money known A.K.A. Energies Trading Leverage Example. When you borrow capital from anyone or a bank you must maintain a security or collateral to acquire a loan, even if the security is based on monthly deduction from your salary, same thing with Energies.

In energies the security is known as margin. This is the capital you deposit with your broker.

This is calculated in real time as you trade. To keep your borrowed money you must maintain what is known as the required capital (your deposit).

Now if Your Energies Trading Leverage Example is 100:1

When trading if you have $1,000 & use option 100:1 & buy 1 standard lot for $100,000 your margin on this transaction is the $1000 dollars in your account, this is money that you will lose if your open trade goes against you the other $99,000 that is borrowed, they will close the open energies trades automatically once your $1,000 has been taken by the energies market.

But this is if your energies broker has set 0% Energies Margin Requirement before closing your energies trades automatically.

For 20% requirement before closing your energies trades automatically, then your trades will be closed once your trading account balance gets to $200

For 50% requirement of this level before closing your energies trades automatically, then your trade transactions will be closed out once your trade account balance gets to $500

If they set 100% requirement of this level before closing your open positions automatically, then your trade will be closed once your trade account balance gets to $1,000: Meaning trade will close out as soon as you execute it because even if you pay 1 pip spread your trading account balance will go to $990 & the needed percentage is 100% i.e. 1,000 dollars, therefore your orders will immediately get closed.

Most brokers do not set 100% requirement, but there are those who set 100% are not suitable for you at all, choose those set 50% or 20% margin requirements, in fact, those energies brokers that set at 20% are some of the best because the likely hood they close-out your trade is reduced as displayed in examples above.

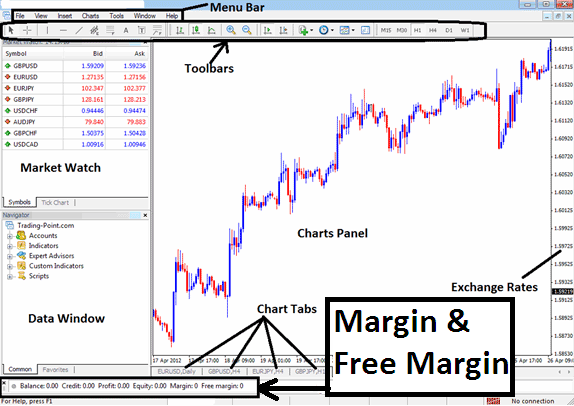

To know about this level which is calculated by your platform automatically - The MT4 Energies Trading Platform will display this as "Energies Trading Margin Requirement", This will be displayed as a percentage higher the percentage the less likely your trades are to get closed.

For Example if

Using 100:1

If energies trading Leverage Example is 100:1 and you transact energies lots equal to $10,000

$10,000 dollars divide by 100:1, your used capital is $100

Calculation:

= Capital Used * Percentage(100)

= $1,000/$100 * Percentage(100)

Energies Trading Margin Requirement = 1,000 %

Investor has 980% above the required amount

Using 10:1

If energies trading Leverage Example is 10:1 and you transact energies lots equal to $10,000

$10,000 dollars divide by 10:1, your used trading capital is $1000

Calculation:

= Capital Used * Percentage(100)

= $1,000/$1000 * Percentage(100)

Energies Trading Margin Requirement = 100 %

Investor has 80% above the required amount

Because when a trader has a higher energies trading Leverage Example means that they have more percentage above what is required(A.K.A. More "Free Energies Trading Margin") their open energies transactions are less likely to get closed. This is the reason why traders will choose the option 100:1 for their account but according to their risk management rules, these traders will not trade above 5:1.

These Areas are Shown on The Software Screen Shot Below as an Example:

MetaTrader 4 Energies Trading Software