Multiple Time Frame Analysis

Multiple time frames analysis equals using 2 chart timeframes to trade energies - a shorter one used for trading and a longer one to check the Energies trend.

Since it's always good to follow the trend, in Multiple Time Frame Analysis, the longer time frame gives us the direction of the long-term trend.

If the long-term market direction supports the direction of the smaller chart timeframe then the probability of being profitable is greatly increased. This is because even if you make a mistake the long-term energies trend will eventually save you. Also if you trade with the direction of the market, then mostly you will be on the winning side, this is what this analysis is all about.

Remember there is a popular saying by many Energies Trading and energies market investors that says: "The energies trend is your friend' - never go against the energies market.

There are four different types of Energies traders - all these use different energies charts to trade as explained below.

Examples of how each type of trader uses multiple Time Frames analysis Energies trading strategy:

Scalpers

This group holds on to their trades for only a few minutes. Scalper never holds on to a trade for more than ten minutes. With the aim to make small amount of pips profit, 5 - 20 pips.

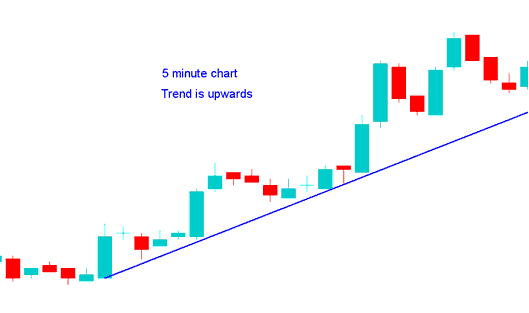

A Scalper using 1 min chart wants to go long, checks 5 min chart, which looks like the one below, since 5 min show energies trend is heading up, then decides from this analysis it's ok to buy.

Day Traders

This group holds on to their trades for a few hours but not more than a day. With the objective to make quite a number of pips, 30 - 100 pips.

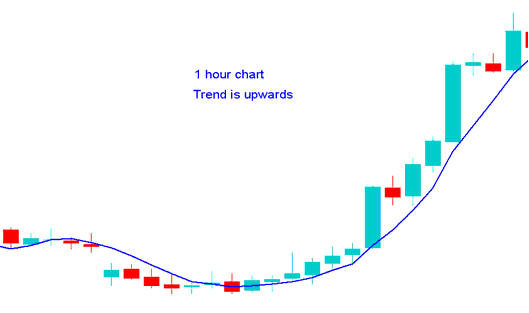

Day trader trading 15 minutes chart wants to go long, checks 1 hour chart, which looks like the one below, since 1 hour portrays market energies trend is heading up, then decides from this analysis it's ok to buy

Swing Traders

This group holds on to their trades for a few days to a week. With the aim to make a big number of pips, 100 - 400 pips.

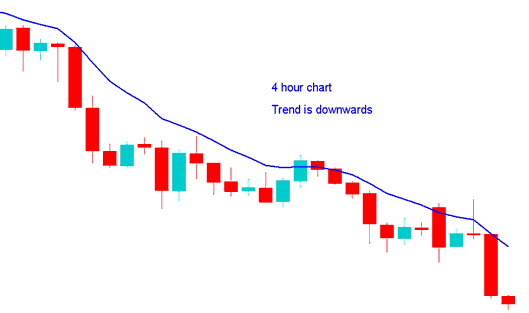

Swing trader using 1 hour chart wants to go short, checks 4 hour chart, which looks like the energies example shown and described below, since 4 hour portrays the energies trend is heading down, then decides from this analysis it is okay to sell.

Position traders

These are the investors that hold on to their trades for weeks or months. With the aim to make a big number of pips, 300 - 1000 pips.

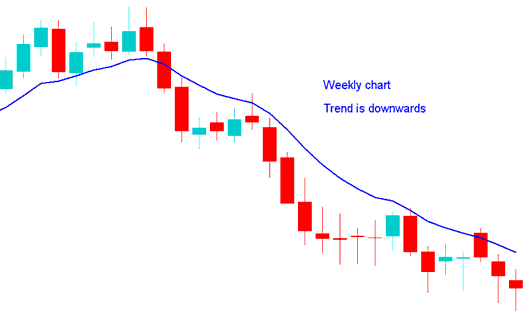

Position trader using daily chart wants to short sell, checks weekly chart, weekly looks like one below, since weekly portrays the energies trend is heading down, then decides from this analysis it is okay to sell.

How to Define A Trend

Using a energies system has Three indicators - Moving Average Crossover System, RSI and MACD and uses simple trading rules to define the trend. The rules are:

Upward trend

Both MAs Moving Up

RSI above 50

MACD Above Center Line

Downward Energies Trend

Both MAs Moving Down

RSI below 50

MACD Below Center Line

For More explanation about this system read: How to Generate Trading Signals With a Energies Strategy.