Moving Average Commodity Technical Analysis & Moving Average Trading Signals

An technical indicator that calculates the average value of commodity prices (or any specified price data series) over a predetermined period of time.

The only significant difference between the various types of MAs is the weight assigned to the most recent data. Simple moving averages apply equal weight to the commodities prices. Exponential and weighted averages apply more weight to recent commodities prices.

Explanation

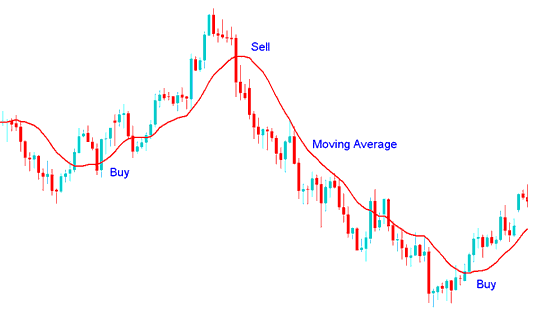

The most popular method of interpreting the MA is to compare the relationship between the MA of the commodities price with the commodities price itself. A buy commodity signal is generated when the commodities price rises above its MA and a sell commodity signal is generated when the commodities price falls below its Moving Average.

MA Technical Indicator

Buy & Sell Commodity Trading Signals generated by MA crossing above or below the commodities price action.

Moving Average Crossover Commodities Trading Strategies

Also popular are various types of moving average cross over systems. Such systems often include 2 or more moving averages crossing above/below each other & perhaps even utilizing other technical indicators as additional entry & exit confirmation signals. The combinations of conditions for these types of trading systems are almost limitless.

Moving Average Crossover System