How to Trade a Commodities Trend Reversal

Commodity Trendline Break

After commodities trading price has moved in a certain direction for an extended period of time within a commodity trend it reaches a point where it stops moving within the commodities trend. When this happens we say that the commodity trend line has been broken & this is interpreted as a commodity trend reversal commodities trade signal.

Since the commodity trend line is the point of support or resistance and this point of support or resistance has been broken after a commodity trendline break - we then expect the commodities trading price to move towards the opposite direction and this is interpreted as a commodity trend reversal commodities trade signal.

When this happens commodity traders will close the open commodity orders which they had bought or sold. This is referred to as taking profit.

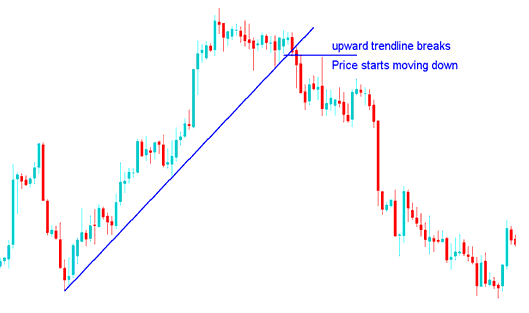

Up Commodity trading trend Commodities Reversal

When commodities trading price breaks-out below the upward commodity trend line (support) commodity market will then move downwards

Commodities Upward Commodities Trendline Break - How to Identify a Commodities Trend Reversal Trading Signal

This commodity trend reversal trading signal is considered to be confirmerd with the formation of a lower high of the commodities price. This also provides a trading opportunity to sell once the commodity trend line is broken - commodities trading reversal signal.

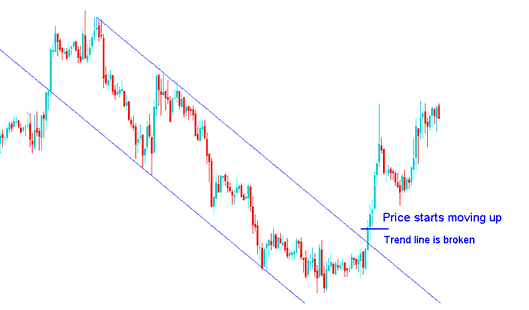

Down Commodity trading trend Commodities Reversal

When commodities trading price breaks out above the downward line (resistance) the commodities trading price will then move up

Commodities Downward Commodities Trend Line Break -How to Identify a Commodities Trend Reversal Trading Signal

This commodity trend reversal commodity signal is considered to be complete with the formation of higher low. This commodity reversal trading setup also provides a trading opportunity to open a buy commodity trade once the commodity trend line is broken - commodity trend line reversal commodities trade signal.

NB: Sometimes when commodities trading price breaks its commodity trend it might first of all consolidate before moving in the opposite direction. Either way it is always good to take profit when the commodity market commodity trend reverses.

To trade this commodity reversal setup as a trader once you open a new commodity trade in direction of the commodity trend reversal the commodities trading price should immediately move in that direction, in a commodities trading price break-out manner. This means that the commodities prices should immediately move in that direction without much of a resistance.

If on the other hand the commodities trading prices do not immediately move in direction of the commodities trading price breakout then it is best to close out the commodity trade because it means that the commodity trend is still holding.

Another tip is to wait for the commodity trend line to be broken & for the commodity market to close above or below it so as to confirm this commodity trend reversal commodities trade signal.

What happens is that most traders open trades waiting for a commodity reversal even before the commodity trend is broken, only for the commodities trading price to touch this commodity trend line & for the current market commodity trend direction to hold and the commodity instrument to continue with the current market trend.

Therefore, when trading this commodity reversal setup it is best to wait until the commodities trading price break out has been confirmed by commodities trading price closing above or below the commodity trendline, depending on the direction of the market.

- Upwards Market Commodities Trend Direction Reversal - this reversal commodity signal is confirmed once the commodities trading price closes below this upward commodity trendline, this should be the correct time to open a sell commodity trade, so as to avoid a commodity whipsaw.

- Downwards Market Commodities Trend Direction Reversal - this reversal commodity signal is confirmed once the commodities trading price closes above the downward commodity trendline, this should be the correct time to open a buy commodity trade, so as to avoid a commodity whipsaw.