Candle Stick Commodity Trading Price Action Trading

How to Analyze Commodity Trading Price Action Trading Using Japanese Commodity Trading Candlesticks

The Japanese commodity candlesticks techniques also have very many commodities price action pattern formations that are used to trade Commodities. These commodities price action patterns have different technical analysis interpretation & the most common are:

The above commodity action commodities price patterns is what makes the Japanese commodity candlesticks popular among technical commodity traders & it is why this type of commodities price action commodity analysis are the most widely used when it comes to analyzing the commodities market. The technical analysis for these commodities price action commodity pattern formations in commodities trading is explained in the above commodity candlesticks trading price action lessons.

What is a Commodity Trading Candlestick?

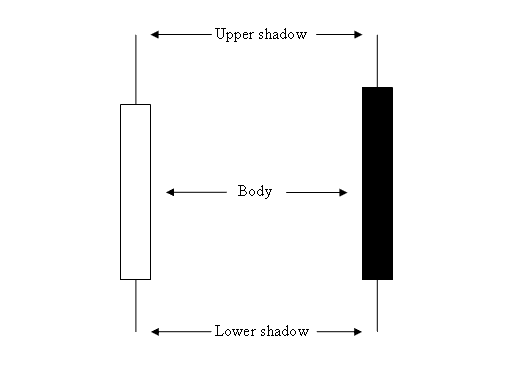

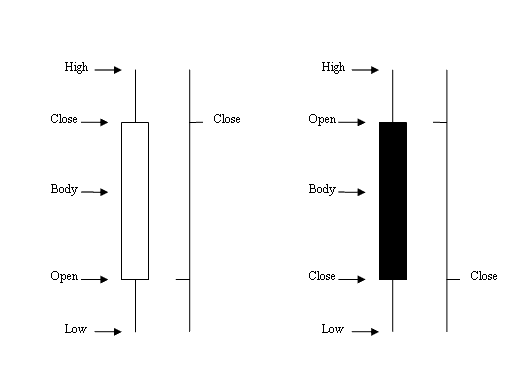

Commodity Trading Candlesticks - is a commodities price representation that uses the commodities price data (open, high, low, and close of commodities price). These candlesticks resemble a candle with wicks on both ends.

Rectangle part of the candle-stick is called the body.

The high and low are described as shadows & plotted as poking lines.

Candlestick Commodity Trading Price Action Trading

The color of the candlestick is either blue or red

- (Blue or Green Color candle) - Commodities Prices moved up

- (Red Color candlestick) - Commodities Prices moved down

Most commodities trading platforms like the MT4, use colors to mark the direction of the commodity candlesticks. Colors used are blue or green: when commodities price moves up, red: when commodities price moves down.

Candlesticks Commodity Trading Price Action Chart Vs. Bar Commodities Trade Charts - Candlestick Commodity Trading Price Action Trading

When candlesticks commodities price charts are used it is very easy to see if the commodities price moved up or down as opposed to when bars are used.

Commodities candlesticks and commodity candlesticks patterns are commonly used in commodities price action trading strategies used to trade commodity.