How to Commodities Trade With Commodity Trading Fibonacci Extension

Commodity Fibonacci Extension Levels Trading Strategies in Commodities

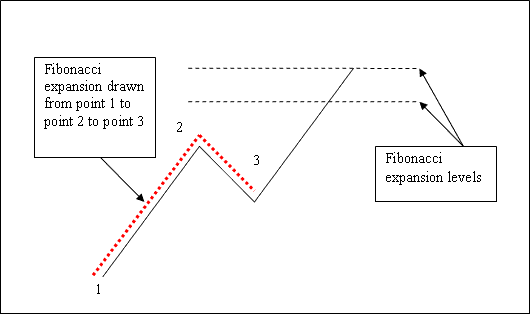

Fib extension levels indicator is drawn using Three chart points.

To draw Commodity Fibonacci Extension levels we wait until the commodities price retracement is complete & the commodities price starts to move in original direction of the Commodities trend. Where the retracement reaches is used as chart point 3.

The Fibonacci extension example illustrated and explained below shows the 3 Chart Points where the Fibonacci extension indicator is drawn, marked as Chart point 1, 2 and 3. Chart point 1 is where the commodity trend started, Chart point 2 is where the commodity trend pulled back & retraced and Chart point 3 is where the commodity retracement reached as displayed on the Commodity Fibonacci Extension Indicator examples illustrated & described below.

Commodities Trade With Commodity Trading Fibo Extension?

Please note where these Commodity Fib Extension areas are drawn - Commodity Fibonacci Extension zones are drawn above the Fibo Technical Indicator, these are the points where the trader will set the takeprofit orders using these Commodity Fibonacci Extension Levels - 61.8% and 100% Commodity Fibonacci Extension Areas.

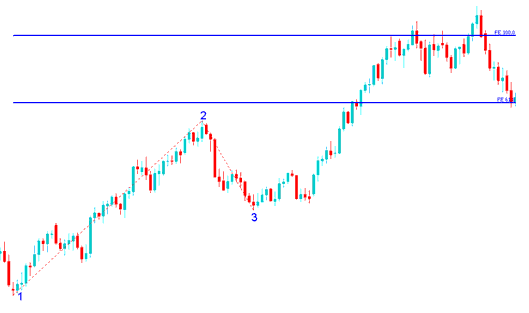

Drawing Commodity Fibonacci Extension Zones on an Upward Commodities Trend

We use Fibonacci extension levels to estimate where the commodity trend movement will reach. There are Two important Fibo extension levels: 61.8% and 100% Commodity Fibonacci Extension Levels, these are used for profit taking.

On the Fibonacci extension example illustrated and explained below you can see that the Fibonacci extension technical indicator is plotted along the direction of the commodity trend, since the commodity trend is upwards - the Fibonacci extension is also drawn upwards.

These Fibo extension levels are displayed as horizontal lines above the Commodity Fibonacci Extension technical indicator, showing the profit taking areas. In the commodity example illustrated and explained below if you had used of 100% Fibonacci extension you would have made nice profit from the trade set-up.

Drawing Commodity Fibonacci Extension Areas Technical Indicator on an Upward Commodities Trend - Commodity Fibonacci Extension Trading Levels Strategies in Commodity Trading

From the above Fibonacci extension examples, the upward commodity trend continued & both 61.80% and 100.00% Fibonacci extension levels were all hit after which commodities price retraced again after getting to the 100.0 % Commodity Trading Fibo Extension level.

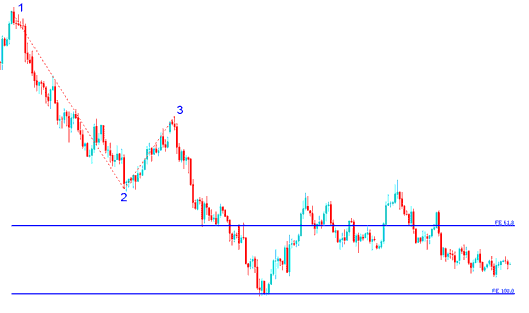

Drawing Commodities Fibonacci Extension Areas Technical Indicator on a Downward Commodities Trend

Since we use this Fibonacci extension indicator to estimate take profit levels, how do we draw it in a downwards trend?

We draw the Fibonacci extension indicator from chart point 1 to 2 to 3 as shown below. Remember we always draw this Fibonacci extension tool in direction of the commodities trend. In the Fibonacci extension example illustrated and explained below, can you figure what direction we have drawn it? That is right - downwards direction.

Try & identify the difference between how we have plotted the Fibo extension above and how Commodity Fibonacci Extension is drawn below. This time you would also have used Fibonacci extension level 100%, just where the commodities price reached as shown on the commodity example illustrated and explained below. That would have been a nice take profit area.

Drawing Commodity Fibonacci Extension Levels Technical Indicator on a Downward Commodities Trend - Commodity Fibonacci Extension Technical Levels Trading Strategies in Commodity Trading

From the Fibonacci extension example above, after plotting this Fibonacci extension tool there are 2 levels that are used to show the profit taking areas, these two Fibonacci extension levels are drawn as horizontal lines across the commodities price chart.