How to Trade Commodities Downward Commodities Trend Line Reversal Signals Combined with Double Bottoms Reversal Commodities Trading Chart Patterns Commodity Trading Setups

Downwards Commodities Trend Reversal Commodity Trading Signals and Double Bottoms Reversal Commodities Trading Chart Patterns Strategy

Down Commodities trading trend Commodity Reversal

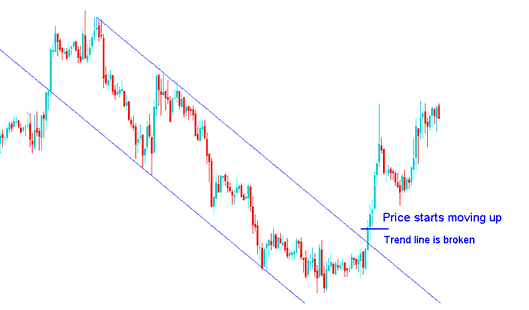

When commodities trading price breaks-out downwards commodity trend line (resistance) commodity market will then move up

Downwards Commodities Trend Line - Commodities Trend Reversal Signal

This signal is considered to be complete with the formation of a higher low or higher high. This reversal commodity trendline break can also be combined with the double bottom reversal commodity chart patterns as described on the commodity example illustrated and explained below:

Combining Downwards Commodities Trend Reversal Commodity Trading Signals with Double Bottoms Reversal Commodities Trading Chart Patterns

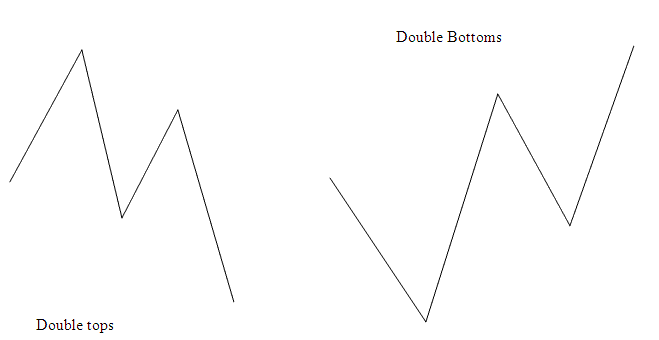

A good commodity reversal trade setup to combine commodity trendline break reversal strategy with is the double bottom commodity patterns - Double Bottoms Reversal Chart patterns Guide.

Double bottom reversal commodity chart patterns setup should already have formed before the down commodity trend break commodity reversal signal. Because the double bottom are also reversal commodity signals, then combining these two reversal trading strategies will give the trader a good probability of avoiding a commodity whipsaw.

In the above commodity chart example these double bottoms setups can be confirmed to have formed even before the commodity trend line reversal commodity signal appeared.

Examples of Downward Direction Reversal - the Double bottoms reversal commodities trading pattern had already formed before the down commodity trendline break reversal signal appeared on commodities chart.

Combining Downwards Commodities Trend Reversal Commodity Trading Signals with Double Bottoms Reversal Commodities Trading Chart Patterns