How to Use Support & Resistance to Trade Commodities

In the above previous course trades example we have looked at support and resistance levels that were not broken. These points held because they were strong enough.

However, sometimes support and resistances levels are not strong enough to stop movement of the commodities trading price moving in a certain direction. When commodities price moves past these support & resistance points we say that these levels have been broken. That's why we always use a stop loss when trading these levels, just in case they don't hold.

But what happens when these levels are broken, well the levels change one to the other, for example

- When a support is broken it becomes a resistance

- When a resistance is broken it becomes a support

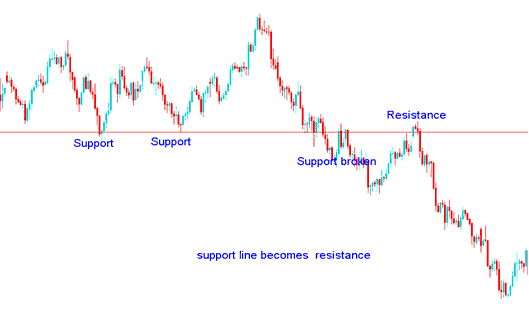

Using charts, the example below show an illustration of what happens when these levels break:

Support is broken it becomes a resistance

In the commodity example illustrated and explained below, the support that had been tested two times could not hold the third time, the sellers were able to push the commodities trading price down past this level.

However, the commodities trading price bounced back up again, but this time the commodities trading price could not go up beyond this line. The commodities price was there after quickly pushed down by the sellers. This was because the line that was a support had now turned into a resistance.

In commodities trading when a support is taken out, the stop losses placed below that level are also taken out, thus reducing the momentum that the buyers had. This give sellers an opportunity to short sell the commodities and place their stops just above this level which now turns into a resistance level.

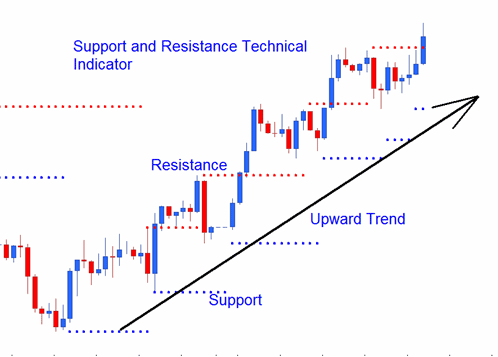

Resistance is broken it becomes a support

In the commodity example illustrated and explained below using the commodities chart, the resistance level that had been tested two times could not hold the third time, the bulls were able to push the commodities trading price up past this level.

When the commodities trading price tried to go down again it could not go lower than this level. The commodities trading price was there after quickly pushed further upwards by the buyers. This was because the line that was a resistance had now turned into a support. This is what happens in commodities trading, when a resistance level is broken it turn into a support level.

Traders who had closed their short sell commodities trades will now open long trades and place their stop losses just below this level.

Major and Minor Resistance Areas

In commodities trading charts the resistance and support levels formed are either major resistance/support points or minor resistance/support points.

Major Resistance/Support levels

In Major Resistance/Support levels commodities trading price will stay at this level for some time, either the commodities trading price will consolidate at this point or form a rectangle commodity chart pattern when commodities trading price gets to this point. This level will be tested several times before it is either broken or it holds and commodities trading price does not get to move past this resistance/support level.

The above example are good example of major Resistance & Support Levels.

Minor Resistance/Support levels

In minor resistance and support points the commodities price will form these points quickly in the short term & then quickly move past these resistance regions & support regions.

Upwards Commodities Trading Trend: The pattern of this minor resistance and support points will form a series of areas whose general direction is upwards.

Upwards Commodity Trend Series of Support & Resistance

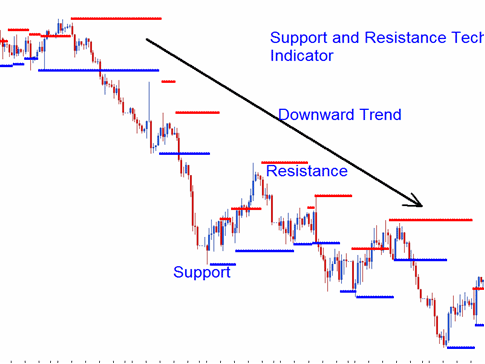

Downwards Commodity Trend: The pattern of this minor resistance and support points will form a series of areas whose general direction is downward.

Downwards Commodity Trend Series of Support & Resistance