How to Trade Commodities Classic Bullish Divergence & Bearish Divergence

In commodities trading, classic divergence is used as a possible sign for a commodity trend reversal and is used by commodity traders when looking for an area where commodities trading price could reverse and start going in the opposite direction. For this reason this commodity setup is used as a low risk entry method and also as an accurate way of exit out of a commodities trade.

This strategy is a low risk method to sell near the top or buy near the bottom, this makes the risk on your trades are very small relative to the potential reward. However, this is one technique with very many whipsaws and most traders do not recommend using it.

Divergence in Trading is also used to predict the optimum point at which to exit a trade. If you already have an open trade that is already profitable, a good way to identify a profit taking level would be the point where you identify this commodities trading setup.

There are 2 types, based on the direction of the Commodities trend:

- Classic Bullish divergence

- Classic Bearish divergence

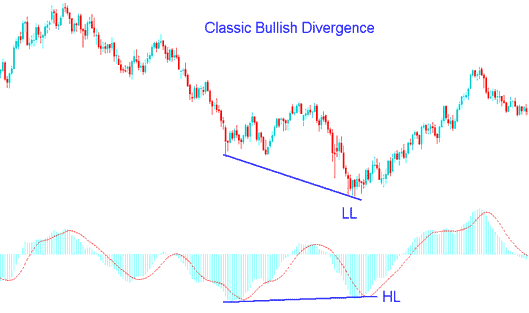

Commodity Trading Classic Bullish Divergence

Classic bullish divergence set-up forms when commodities price is forming lower lows ( LL ), but the oscillator is making higher lows (HL). The example illustrated and explained below shows a picture of this commodities trading setup.

Commodities Trading Classic Bullish Divergence

This examples uses MACD indicator as a Commodity Trading divergence indicator.

From the above example the commodities price made a lower low(LL) but the indicator made a higher low(HL), this shows there is a divergence between the commodities price and indicator. This signal warns of a possible commodity trend reversal.

Classic bullish diverging signal warns of a possible change in commodity trend from down to up. This is because even though the commodities trading price went lower the volume of sellers who pushed the commodities trading price lower was less as illustrated by the MACD technical indicator. This indicates underlying weakness of the downwards commodities trend.

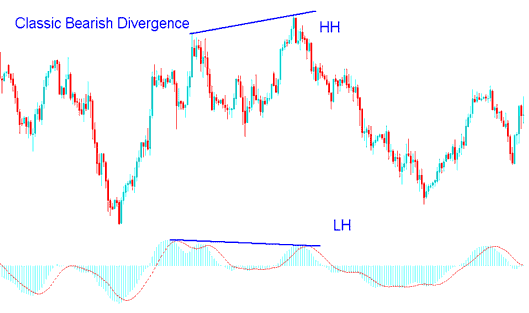

Classic bearish Commodities Trading Divergence Setup

Classic bearish divergence setup occurs when commodities price is showing a higher high ( HH ), but the oscillator is lower high (LH). The image below shows an example of the setup.

Commodity Trading Classic Bearish Divergence

This examples also uses MACD indicator

From the above example the commodities price made a higher high(HH) but the indicator made a Lower High(LH), this shows there is a divergence between the commodities price and indicator. This signal warns of a possible commodity trend reversal.

Classic bearish diverging signal warns of a possible change in the commodity trend from up to down. This is because even though the commodities trading price went higher the volume of buyers who pushed the commodities trading price higher was less as illustrated by the MACD indicator. This indicates underlying weakness of the upward commodities trend.

In the above example, if as a trader you had used divergence trade setup to trade you would have gotten good trading signals to enter or exit the trades at an optimal point. However, divergence signals just like other indicators, is also prone to whipsaws. That's why it is always good to confirm the diverging signals with other technical indicators such as the RSI, Moving Averages & Stochastic Oscillator.

A good indicator to combine classic diverging setups is the stochastic oscillator & wait for the stochastic lines to move in direction of the divergence signal so as to confirm the trading signal.

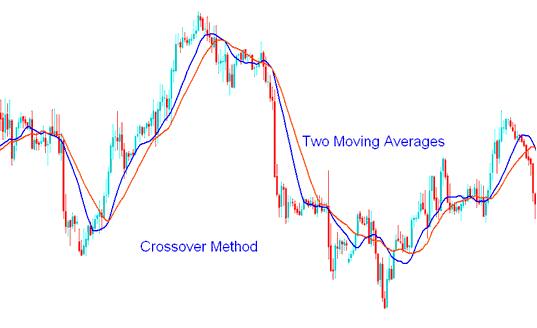

Another good technical indicator to combine with is the moving average technical indicator, in this technical indicator a trader should use the Moving Average Crossover System

Example of Moving Average Crossover Technique Strategy

Once the divergence signal is given, a trader will then wait for the Moving average crossover system to give a signal in the same direction, if there is a classic bullish setup, a trader will wait for the moving average system to give an upward crossover signal, while for a bearish classic divergence signal the trader should wait for the Moving average cross-over system to give a downward bearish crossover trading signal.

By combining the classic divergence trading signals with other indicators this way, a trader will be able to avoid whipsaws when it comes to trading the classic diverging signals, because the trader will wait until the commodity market has actually reversed and is already moving towards this direction, hence the trader will not fall into the trap of picking market tops and bottoms.