Importance of XAUUSD Risk Management

Tools of Minimizing Gold Risk

Best way to practice money management in Gold Trading is for a trader to use Tools of Minimizing Gold Risk - Objectives of Gold Risk Management & keep losses lower than the profits they make in Gold Trading. This is called risk:reward ratio.

How to Mitigate XAUUSD Risk

This xauusd trading money management strategy is one of the Tools of Minimizing Gold Risk - Objectives of Gold Risk Management used to increase the profitability of a Gold Trading strategy by trading only when you as a trader have potential to make more than Three times more what you are risking - Trading Gold Risk Management Course - Importance of Gold Risk Management.

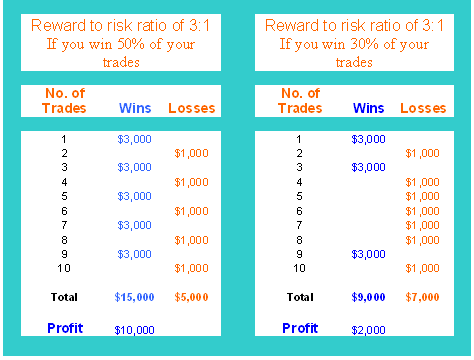

If you trade using a high risk: reward ratio of 3:1 or more, you greatly increase your chances of becoming profitable in the long run when Gold Trading. TheXAUUSD Chart below shows you how: Tools of Minimizing Gold Risk - Objectives of Gold Risk Management

Gold: A Gold Trader's Money Management System Tutorial: Trading Gold Risk Management Tutorial

In the first gold example, you can see that even if you only won 50% of your gold trade transactions in your Gold Trading account, you would still make profit of $10,000 - Importance of Gold Risk Management.

Even if your Gold Trading system win rate went lower to about 30% you would still end up profitable - Trading Gold Risk Management Course - How to Mitigate Gold Risk.

How to Mitigate Gold Risk - Just remember that whenever you have a good risk to reward ratio How to Mitigate Gold Risk, your chances of being profitable as a trader are greater even if you have a lower win percent for your Gold Trading system.

Never use a risk to reward ratio where you can lose more pips on one gold trade than you plan to make. It does not make sense to risk 1,000 dollars so as to make only 100 dollars when trading the xauusd market.

Because you have to win 10 times which to make the 1,000 dollars back. If you ONLY lose once in your Gold Trading then you have to give back all your Gold Trading profits.

This type of Gold Trading strategy makes no sense & you will lose on the long term if you use a Gold Trading strategy like this that is why you need Better Gold Trading: Money & Risk Management Gold Trading Plan.

How to Mitigate Gold Risk

The percent risk xauusd trading money management strategy is a method where you risk the same percent of your gold trading account balance per gold trade transaction - Tools of Minimizing Gold Risk - Objectives of Gold Risk Management.

Percent risk gold money management technique specify that there will be a certain percent of your gold trading account equity balance that is at risk per each gold trade. To calculate the percentage risk per each gold trade, you need to know about 2 things, percentage risk that you have chosen in your gold trading money management plan & lot size of an open gold order so as to calculate where to put the stop loss order for your trade. Since the percent risk is known, a trader will use it to calculate the lot size of the gold trade order to be placed in the xauusd market, this is known as position size.

Importance of XAUUSD Risk Management - How to Mitigate Gold Risk

Maximum Number of Open Gold Trade Positions

Another point to consider is the maximum number of open xauusd trades that is the maximum number of xauusd trades you want to be in at any one given time when trading gold. This is another factor to decide when coming up with - Trading Gold Risk Management PDF.

If for examples, you choose a 2% percent risk in your gold trading plan, you may also select to be in a maximum of 5 gold trades at any one given time when trading the gold market. If all 5 of those gold trade positions close at a loss on the same day, then as a trader you would have an 10% decrease in your gold trading account balance that day.

Invest with Sufficient Gold Trading Capital - Importance of Gold Risk Management

One of the worst mistakes that traders & traders can make in gold trading is attempting to open a gold trading account without sufficient capital.

The gold trader with limited gold capital will be a worried trader, always looking to minimize gold trading losses beyond the point of realistic gold trading, but will also be oftenly taken out of the xauusd trades before realizing any success out of their gold trading strategy.

- Exercise Discipline When Gold Trading - Importance of Gold Risk Management

Discipline is most important thing which a trader can master to so as to become profitable. Discipline is ability to plan your gold trade & stick to the money management guidelines of your gold trading plan.

A gold trading plan will allow a trader to become disciplined and discipline will give you as a gold the ability to allow a gold trade the time to create without quickly taking yourself out of the xauusd market simply because you're uncomfortable with risk. Discipline is also the ability to continue to stick to your gold trading plan even after you have suffered losses. Do your best in gold trading to cultivate the level of discipline that is required so as to be profitable.

Tools of Minimizing XAUUSD Risk

Gold Money management, is the foundation of any gold trading system as gold money management helps traders & traders to get profit when trading on the gold market. Gold money management system is especially important when trading in leveraged gold market, which is considered to be probably one of the more liquid financial market among the many that are there but at the same time also a trader of the riskiest.

If you want to invest & trade successfully in the online gold market you should realize that it is very important to have an effective gold trading money management strategy because you will be using gold trading leverage to place your gold orders - Trading Gold Risk Management PDF.

The difference between average gold trading profits & gold trading losses should be strictly calculated, the gold trading profits on average should be more than the gold trading losses on average when gold trading, otherwise gold trading will not yield any profits. In this case a trader has to formulate their own gold trading account management rules, the success of each trader depends on their individual traits. Therefore, every makes his own gold trading strategy & formulates their own gold trading money management guidelines based on the above money management strategy guidelines - Gold Trading Tools of Minimizing Gold Risk - Objectives of Gold Risk Management.

When you are placing your gold orders in the gold market put your stoploss orders so as to avoid huge gold trading losses. Gold trading stoploss orders can also be used to lock in gold trading profit while trading the xauusd market.

Consider the chance to get gold trading profit against chance to get gold trading loss as 3:1 - this risk : reward ratio should be favorable more on profit side - Importance of XAUUSD Risk Management - How to Mitigate Gold Risk.

Considering these gold trading money management guidelines & guidelines - and as gold trader you can use these guide-lines to help improve profitability of your gold trading strategy & try to develop your own gold strategy & gold system that will possibly give you good profits when trading with your Gold Trading Money Management Plan.