Bollinger Bands Gold Indicator Bulge and Squeeze Technical Analysis

The Gold Bollinger Bands are self adjusting which means the bands widen and narrow depending on xauusd trading price volatility.

Standard Deviation is the statistical measure of the xauusd trading price volatility used to calculate the widening or narrowing of the gold trading Bollinger bands. Standard deviation will be higher when prices are changing significantly and lower when the xauusd market xauusd trading prices are calmer.

- When xauusd price volatility is high the Bollinger Bands widen.

- When xauusd trading price volatility is low the Bollinger Bands narrows.

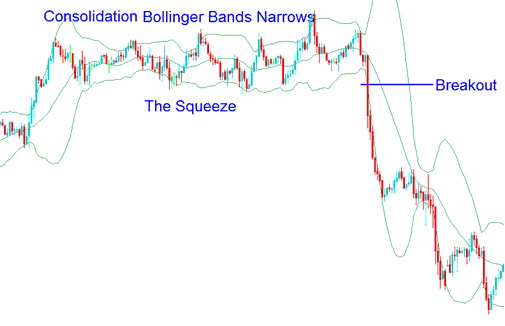

How to Trade Bollinger Bands Squeeze

Narrowing of gold trading Bollinger Bands is a sign of xauusd trading price consolidation & is known as Bollinger band squeeze.

When the Bollinger Bands indicator display narrow standard deviation it is usually a time of xauusd trading price consolidation, and it is a gold signal that there will be a xauusd trading price breakout and it shows gold traders are adjusting their trade positions for a new move. Also, the longer the xauusd trading prices stay within the narrow bands the greater the chance of a xauusd price breakout.

Bollinger Squeeze - The Bollinger Bands Squeeze - How to Trade Bollinger Bands Squeeze

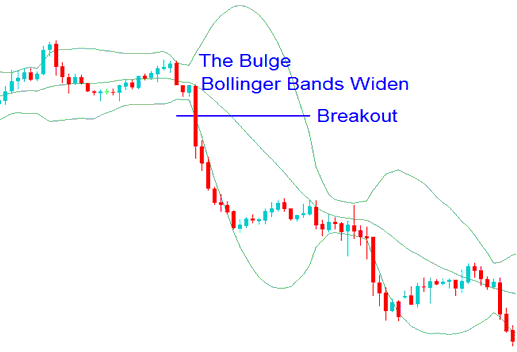

How to Trade Bollinger Bands Bulge

The widening of Bollinger Bands is a sign of a xauusd price break out & is known as Bollinger Band Bulge.

Bollinger Bands that are far apart can serve as a gold signal that a gold trend reversal is approaching. In the Bollinger bands gold indicator example illustrated and explained below, the gold trading Bollinger bands get very wide as a result of high xauusd trading price volatility on the down swing. The gold trend reverses as xauusd trading prices reach an extreme level according to statistics and the theory of normal distribution. The "bulge" predicts the change to a downward xauusd trend.

Bollinger Bulge - The Bollinger Bulge - How to Trade Bollinger Band Bulge