Ehler MESA Adaptive Moving Average Commodities Technical Analysis and Ehlers MESA Trading Signals

Mesa Adaptive Moving Averages was developed by John Ehlers

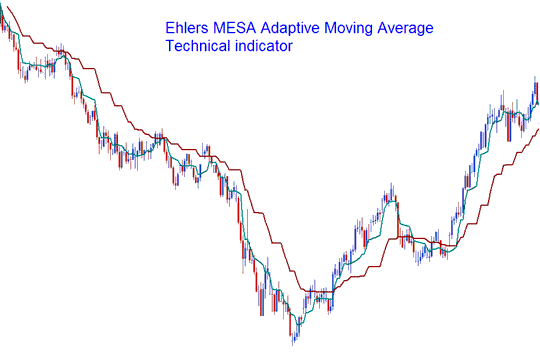

The MESA Adaptive average looks like two moving averages. The difference is that the MESA moves in a staircase manner and not in a curved line like the Moving Average. The example illustrated and explained below shows this indicator drawn on a commodities price chart.

Ehlers MESA Adaptive MA

The MESA Adaptive Moving Average is a commodity trend following indicator that adapts to commodities price action movement based on the rate of change of commodities price as measured by the Hilbert Transform Discriminator. This commodity indicator will generate a trade signal when the two MAs cross one another. Trades should be executed in direction of the MESA averages.

This method features a fast MA and a slow MA so that composite average rapidly follows behind the commodities price changes and holds the average value until the next candlestick close occurs. This commodity indicator is less prone to whipsaws compared with the original Moving averages. This is because of its formula used to calculate the rate of change in relation to the commodities price movement.