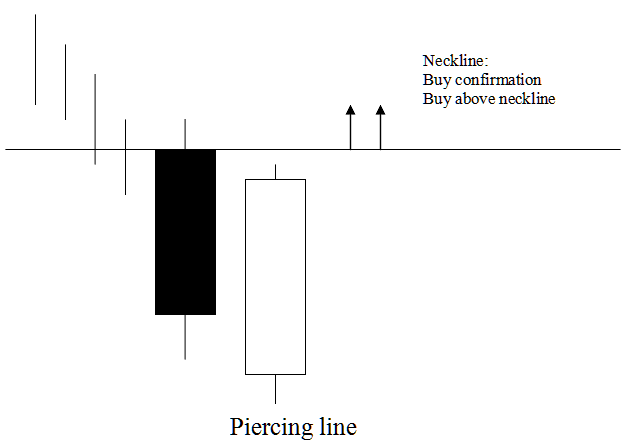

Piercing Line Bullish Candlesticks Pattern

Piercing Line Bullish Candle-stick Setup Patterns

A Piercing Line Stocks Candles Pattern and Dark Cloud Cover Stocks Candlesticks Pattern look alike but the difference is that one occurs at the top of a Stock Trading up stock trend (Cloud Cover) and the other occurs at the bottom of a downwards trend (Piercing).

Upward Stock Trading Trend Reversal - Dark Cloud Cover Candlesticks Patterns

Downward Stock Trading Trend Reversal - Piercing Line Candles Patterns

Piercing Line Stocks Candle-stick Setup

Piercing line candlestick setup is a long black body followed by a long white body candlestick.

The white body pierces the mid point of the prior black body.

Piercing line candle pattern setup is a bullish reversal stock trading pattern that forms at the bottom of a stock market downwards trend. Piercing line candlestick pattern setup highlights that the market opens lower & closes above the midpoint of the black body.

Piercing line candle pattern setup highlights that the momentum of the down stock trend is reducing and the stock trend is likely to reverse & move in an upward direction.

Piercing line candle pattern is shown below and it is known as a piercing line because it signifies that the market is piercing the bottoms showing a market floor for the stock price downward trend.

Piercing Line Stocks Candlestick Pattern

Analysis Piercing Line Candlesticks Pattern

A buy signal is confirmed once price closes above neckline which is the opening of the candle on the left of the Piercing Line candlestick setup.

This is a bullish stock candlestick pattern setup and price should continue moving upwards & for a trader who puts a buy trade - should place stop loss orders just below the lowest stock price region.