What Happens in Silver Trading After a Bullish Reversal Doji XAGUSD Candlestick Pattern?

This bullish reversal doji silver candlestick pattern appears at market turning points in a downward silver trend and warns of a possible silver trend reversal in the Silver Trading market silver trend - from a downward silver trend to an upward trend. Shown Below is an example of this bullish reversal doji xagusd candlestick pattern

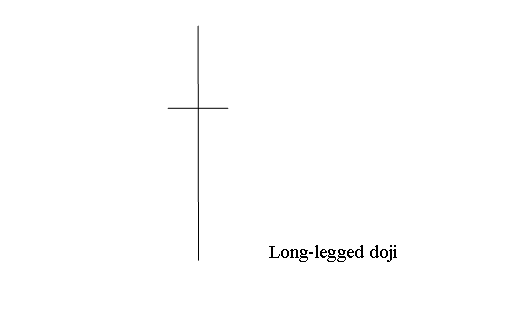

Doji is a silver candlestick pattern with the same opening & closing xagusd trading price. There are various types of doji patterns that are formed on xagusd charts.

A bullish doji candlestick is where xagusd trading price for a particular time period closes almost at the same xagusd trading price. Bullish Doji candlesticks look like a cross, inverted cross or a plus sign and appears at the bottom of a downward silver trend.

This bullish reversal doji silver candlestick pattern appears at market turning points & warns of a possible silver trend reversal in the Silver Trading market. Shown Below is example of this reversal doji silver candlestick pattern that is a bullish doji if it appears at the bottom of a downward xagusd trend.

Bullish Reversal Silver Candlestick Pattern

Analysis of Bullish Doji Silver Candlestick Pattern - All doji candles pattern show indecision in the Silver Trading market this is because at the at the bottom the sellers were in control but none of them could gain control and at the close of the xagusd trading market the xagusd trading price closed unchanged at same xagusd trading price as the opening xagusd trading price. This bullish doji candlestick pattern shows that the overall xagusd trading price movement for that day was zero pips or just a minimum range of 1-3 pips. Reading these candlesticks patterns require very small pip movement between the opening xagusd price & closing xagusd trading price.

When this candlesticks pattern appears at the bottom of a down silver trend then this candlesticks pattern give a bullish silver trend reversal silver signal because it shows the momentum of the sellers is declining.

Once this doji candle pattern is confirmed by xagusd trading price closing higher than the opening xagusd trading price of the candlestick that is drawn prior to the bullish doji candlestick then the bullish silver trend reversal xagusd trade signal will have been confirmed.