Ultimate Oscillator Technical Analysis and Ultimate Oscillator Trading Signals

Originally developed and used to trade stocks and commodities markets.

This oscillator aims at striking a balance between leading signals & lagging signals given by the common indicators.

- Leading - some indicators lead the trading market and give signals earlier than the optimum time

- Lagging - some indicators lag the trading market so far that half of the move is over before a signal is generated.

This is the balance that the oscillator aims to strike, not to lead too much or lag too much - this way the oscillator will always give a signal at the ultimate time, thus its name.

This silver indicator uses 3 different n-number of candlesticks and calculates the combined weighted sums of price action from these candlesticks and plots these values a scale ranging from 0 to 100. Values of above 70 are considered to be overbought levels while values of below 30 are considered to be oversold levels.

The time periods used to calculate the ultimate oscillator are 7 periods (short term trend), 14 periods (intermediate term trend) & 28 periods (long term trend).

Trading Technical Analysis and How to Generate Trading Signals

This indicator can be used in generating buy & sell signals using various methods.

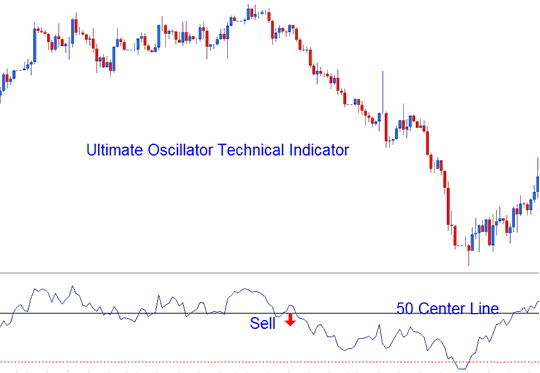

Center line Silver Trading Cross-over Trading Signal

Buy Signal - values above 50 center line level

Sell Trading Signal - values below 50 center-line level

Center line Silver Trading Cross-over Trading Signal

Overbought/Oversold Levels on Indicator

Overbought - levels above 70 - sell silver signal

Oversold - levels below 30 - buy silver signal

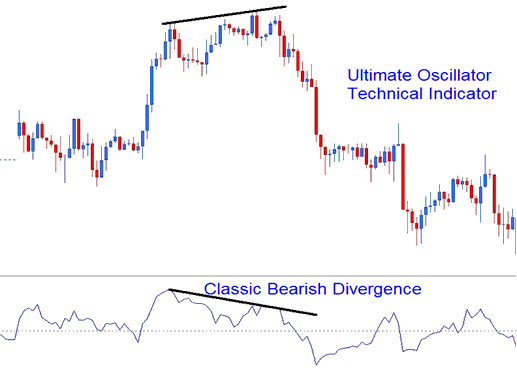

Divergence XAGUSD Trading

The oscillator can also be used to trade divergence signals, below is an example of a classic bearish divergence signal.

Technical Analysis