TSI Silver Technical Analysis and TSI Trading Signals

TSI Indicator

Developed by William Blau

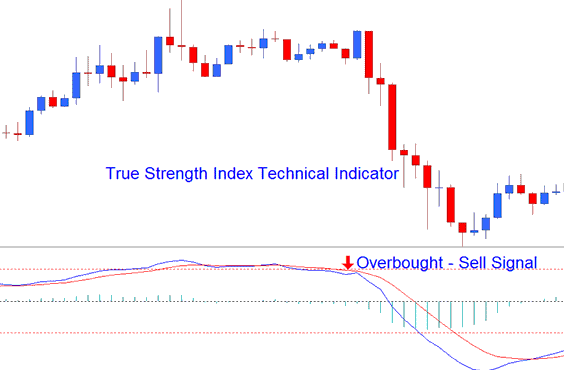

TSI is a momentum indicator. The TSI is drawn by using a momentum calculation that reacts faster and is more responsive to trading price changes, making it a leading indicator that follows price action direction closely in the market.

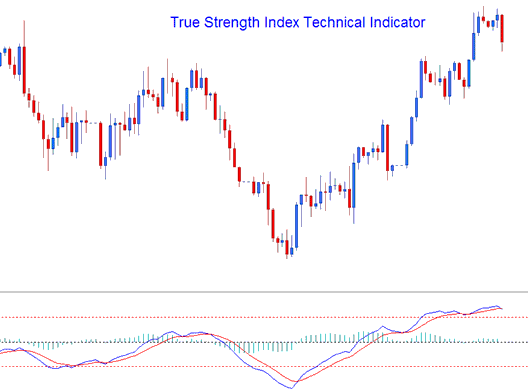

The TSI is drawn as a blue-line, the indicator also plots a signal line which is drawn as a redline, & these two lines are used to generate cross-over signals.

TSI also plots a histogram which shows the difference between the TSI Line & the Signal Line. This histogram crosses above the or below the center-lines, histogram levels above the center-line shows a bullish crossover signal, while center-line levels below the center line shows a bearish crossover signal.

Silver Technical Analysis and Generating Trade Signals

The TSI uses various methods to generate trading signals. This indicator can be used in the same way as the RSI to determine general trend direction of the markets. Overbought and oversold levels can also be shown using TSI. The most common methods of generating trading signals are:

Zero line Silver Trading Cross Over (Histogram Silver Trading crossover not Lines XAGUSD Trading crossover )

- Buy - when the histogram crosses above 0 a buy is generated

- Sell - when the histogram crosses below 0 a sell is generated

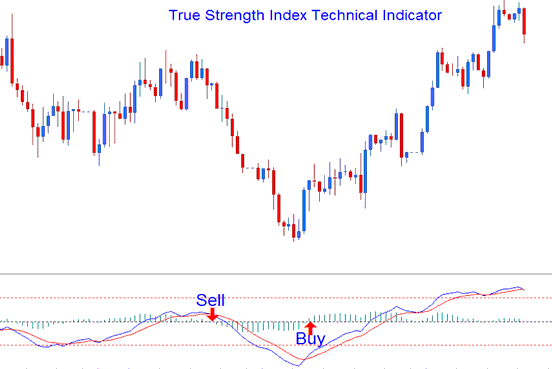

Trading Signal line Silver Trading Crossover

- A buy is generated when the TSI line crosses above Signal-line

- A sell is generated when the TSI line crosses below Signal Line

This signal is the same as the one above and the timing corresponds to the time when the histogram crossovers happen.

Divergence XAGUSD Trading

Divergence is used to look for potential trend reversal point of silver. Reversal divergence setups are:

Classic XAGUSD Trading Divergence

Silver Trade Classic Bullish Divergence: Lower lows in xagusd price & higher lows on the indicator

Silver Trade Classic Bearish Divergence: Higher highs in xagusd trading price & lower highs on the indicator

Divergence trading can also be used in identifying potential trend continuation points in xagusd price action direction. Continuation divergence trading setups are:

Hidden Trade Divergence Setup

Silver Trading Hidden Bullish Divergence: higher lows in xagusd price and lower lows on the indicator

Silver Trading Hidden Bearish Divergence: lower highs in xagusd price and higher highs on the indicator

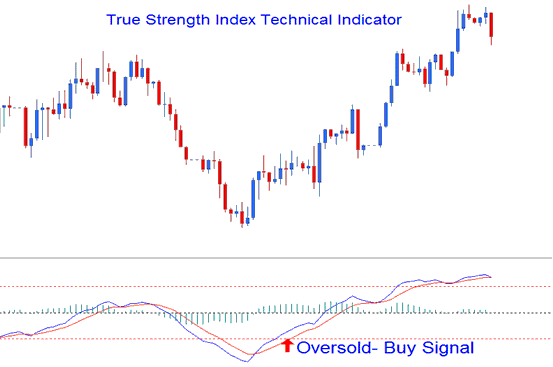

Overbought/Oversold Levels on Indicator

This can be used to identify overbought & oversold conditions in xagusd price action movements.

- Overbought condition - levels being greater than the +25 level

- Oversold condition - levels being less than the -25 level

Trades can be generated when TSI crosses these levels.

Buy signal - when the areas cross above -25 level a buy is generated.

Sell signal - when the areas cross below +25 level a sell is generated.

Oversold - Buy Trading Signal

Overbought - Sell Trading Signal

The overbought/oversold levels are indicated using horizontal lines drawn at the +25 and -25 levels.