Reversal Candle Patterns and Their Confirmation: Hammer Candle Pattern & Hanging Man Silver Candlestick Pattern

Bullish Candle-stick Setups & Bearish Candle-stick Setups

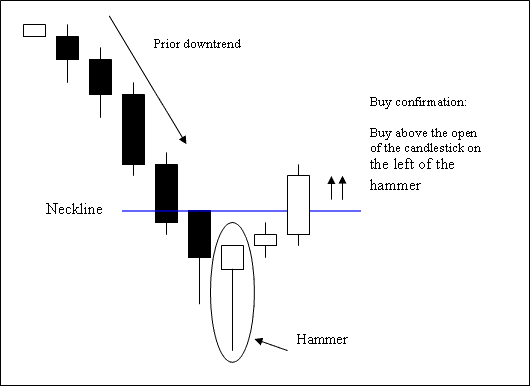

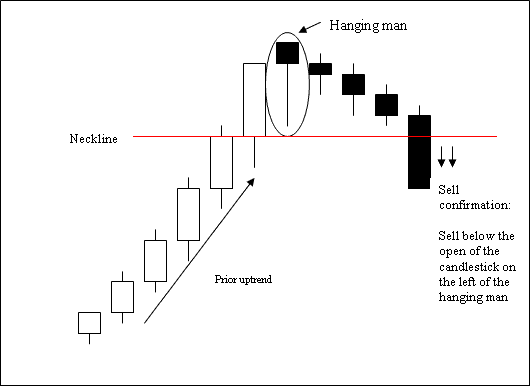

Reversal candlestick patterns occur after an extended prior trend. Therefore, for a candle setup to qualify as a reversal silver setup there must be a prior trend.

These reversal candle stick setups are:

- Hammer Candle Pattern & Hanging Man Candlestick Pattern

- Inverted Hammer Candle Setup and Shooting Star Candlestick Pattern

- Piercing Line Silver Candle Setup & Dark Cloud Cover Candlestick Pattern

- Morning Star Candles & Evening Star Candles

- Engulfing Silver Candles Patterns

Hammer Candle Pattern & Hanging Man Candlestick

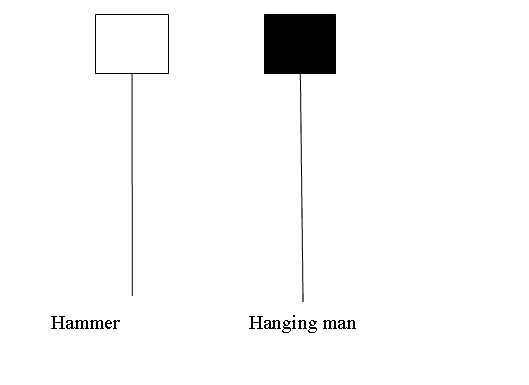

Hammer Candle Pattern & Hanging Man Silver Candle Pattern candlesticks look alike but hammer is bullish reversal silver trading pattern and hanging man is a bearish reversal silver trading pattern.

Hammer Candle Pattern & Hanging Man Silver Candlestick Pattern

Hammer Candlestick

Hammer is a potentially bullish pattern that forms during a downwards silver trend. It's named so because the market is hammering out a market bottom.

A hammer has:

- A small body

- The body is at the top

- The lower shadow is 2 or 3 times the length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body is not important

Hammer Candle

Analysis of Hammer Trading Candlesticks Pattern

The buy silver signal is confirmed when a candle closes above the opening price of the candlestick on the left side of the hammer candle setup.

Stop orders should be set a few pips just below the low of the hammer candle.

Hanging Man Candlestick

This silver trading pattern is a potentially bearish reversal silver signal which forms during a upwards silver trend. It's named so because it looks like a man hanging on a noose up high.

A hanging man candle has:

- A small body

- The body is at the top

- The lower shadow is 2 or 3 times the length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body is not important

Hanging Man Candle

Analysis of Hanging Man Candlesticks

The sell silver signal is confirmed when a bearish candle closes below the open of the candlestick on leftside of this hanging man candle setup.

Stop orders should be set a few pips just above high of the hanging man candle.