MACD Silver Trading Whipsaws & Fake Out Signals on Bearish & Bullish Territory

Since the MACD indicator is a leading indicator which sometimes gives whipsaws, we shall look at an example of a silver trading whipsaw generated by this MACD indicator, so as to illustrate why it's always good to wait for a confirmation signal.

MACD Indicator Silver Trading Whipsaw - Silver Trading Whipsaws

The MACD indicator gave a buy trading signal, when this buy signal was generated and the MACD indicator line was still below the zero center line mark. At this point the buy signal had not been confirmed and it resulted into a silver trading whipsaw as illustrated by the moving averages which continued to move downward.

A silver trading whipsaw signal is as a result of dramatic rise and fall in the price in a short time and in such a manner that skews the data used in calculating the moving averages that draw the MACD indicator data. These types of whipsaw moves are usually brought about because of some news event that can produce market noise.

Traders should have the ability to gauge a silver trading whipsaw and withstand the whipsaw; a silver trading whipsaw might result into an upswing session and then a downswing session. To minimize the risk of silver trading whipsaws, it's good to wait for confirmation of signals by waiting for MACD to cross above or below the zero center-line mark.

Combining MACD Crossover with Center-Line Crossover to Prevent XAGUSD Whipsaws

Buy signal - When there is a crossover, followed by a steep rise in price and then a center-line crossover the buy signal is confirmed.

Sell signal - When there is a crossover, followed by a steep decline in price and then a center-line crossover the sell signal is confirmed.

1. Buy Silver Trading Signal in Bearish Territory Whipsaw

When a buy signal is generated in a bearish territory, it might result into a silver whipsaw especially if it isn't followed soon after by a MACD center-line crossover.

In the trading example explained and shown below, MACD indicator gives a buy signal even though it is in bearish territory, the MACD indicator then turns downwards and starts moving down again resulting into a silver trading whipsaw. By waiting for center line cross-over it is possible to avoid the whipsaw.

However, in this case there was a brief center line crossing: this silver trading whipsaw would have been hard to trade using this MACD indicator alone, that is why it is good to combine the use of MACD indicator with another indicator. In the trading example explained and shown below MACD is combined with the moving average indicators technical analysis.

MACD Silver Whipsaw - Buy Silver Signal in Bearish Territory

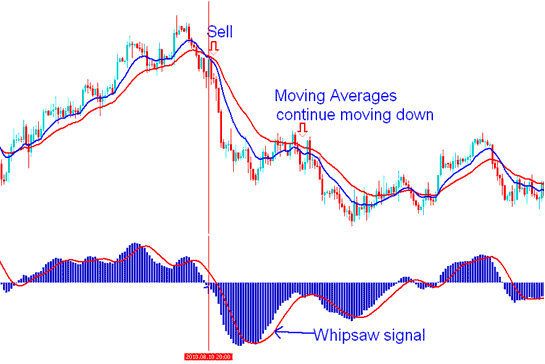

2. Sell Silver Signal in Bullish Territory Whipsaw

When a sell signal is generated in a bullish territory, it might result into a silver whipsaw especially if it isn't followed soon by a MACD center-line crossover.

In the trading example explained and shown below, the MACD indicator gives a sell signal even though it is in bullish territory, the MACD indicator then turns up and starts moving upwards again resulting into a silver trading whipsaw. By waiting for center-line crossover it is possible to avoid the trading whipsaw. In the trading example explained and shown below by combining this MACD indicator with the Moving Average Cross Over Silver Strategy you would have avoided this whipsaw.

MACD Silver Whipsaw - Sell Silver Signal in Bullish Territory

To avoid silver whipsaws completely when trading the trading market with this MACD Indicator it is best to use the Center-line Crossover Signal as the Official Buy or Sell Silver Trading Signal of The MACD Indicator.