What is Oil Price Consolidation in Oil?

Oil Price consolidation in oil is when crude oil prices stop moving upwards or downwards in a oil trend & start to move sideways in what is known as a consolidation.

Oil Price will continue to consolidation and move sideways for a period of time until such a time that one side of the oil market - either the buyers or the sellers gain control of the oil market and either push crude oil prices upward in an upward oil trend or push crude oil prices downward in a downward crude oil trend.

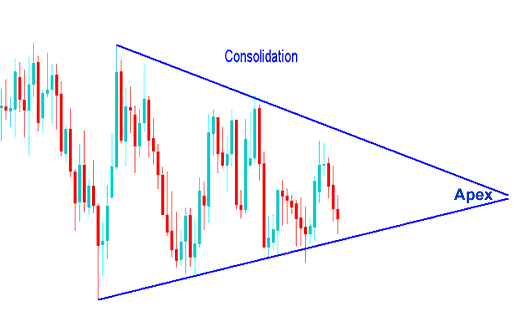

Consolidation Oil Trading Patterns

Symmetrical triangles are oil chart patterns with converging oil trend lines that form a consolidation period and are used to trade the crude oil price consolidation.

Technical buy point from symmetrical triangle is the up-side break of crude oil price consolidation, while a down-side break of the crude oil price consolidation is a technical sell oil signal. Ideally, a market breaks out from a symmetrical triangle prior to reaching apex of the triangle.

When these crude oil price consolidation patterns form we say that the Oil market is taking a pause before deciding next direction to take.

What is Consolidation in Crude Trading? - What is Oil Price Consolidation in Oil?

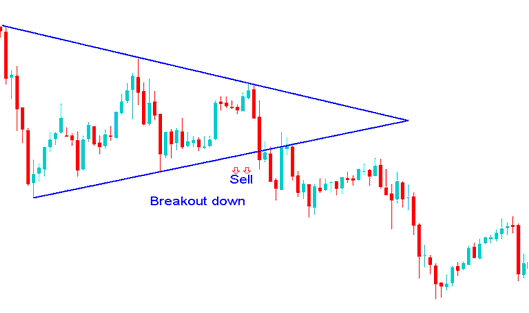

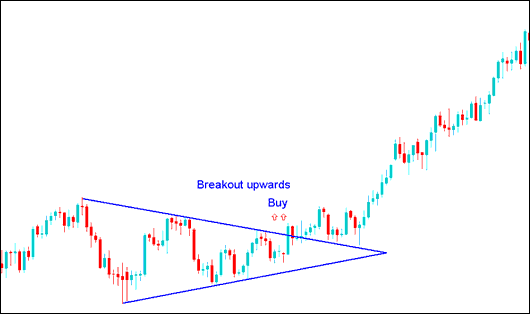

However, this crude oil price consolidation pattern cannot go on forever & just like in a tug of war one side eventually wins, below are 2 examples of how crude oil price consolidation eventually had a breakout pattern and moved in one direction.

Oil Price Break-out Downwards Sell Oil Signal after a Consolidation - What is Consolidation in Oil?

Oil Trading Price Break Out Upwards Buy Oil Signal after a Consolidation - What is Consolidation in Oil?