How to Trade Retracement on Upward Oil Trend

How Do You Draw Crude Oil Fib Retracement for Oil Uptrend?

The Fibonacci retracement indicator is placed on a oil chart in an upward oil trending market and this Crude Oil Trading Fibonacci Retracement indicator then calculates the retracement levels for the oil upward trend on the crude oil charts. Fibonacci retracement levels oil indicator is used by many oil traders as a oil retracement indicator.

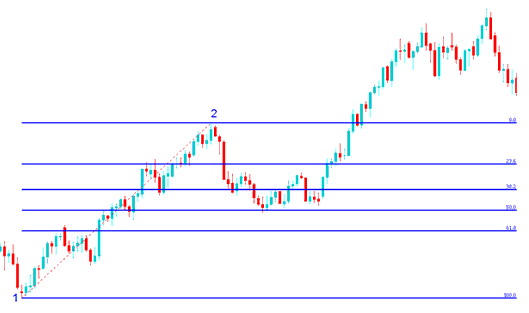

In the Oil Retracement Strategy example shown below the crude crude oil trading price is moving up between chart point 1 & chart point 2 then after chart point 2 it retraces down to 50.0% retracement level then crude crude oil trading price continues moving up in the original upward crude oil trend. Note that this oil Fibonacci retracement indicator is drawn from point 1 to point 2 in the direction of the oil trend (Upwards Direction).

Because we know this is just a retracement based on our oil chart oil trend - using this Fibonacci retracement indicator, we put a buy order just between the levels 38.2% and 50.0% retracement levels and our stop loss just below 61.8% retracement level. If you had put a buy at this point in the trade example shown below you would have made a lot of pips after the crude crude oil trading price retracement reached the Fibonacci 50.0% level and then continued moving in the original upward crude oil trend.

How to Trade Oil Price Retracement on Upwards Oil Trend - Crude Oil Fibo Retracement Levels Trading

Explanation for the Above Oil Trading Fib Retracement Strategy Examples

Once the crude crude oil trading price hit the 50.0% Fibonacci retracement level, this retracement level provided a lot of support for the crude crude oil trading price, & afterwards oil market then resumed the original upwards oil trend and continued to move upward.

23.6% Fibo retracement level provides minimum support & is not an ideal place to place a crude oil trade order.

38.2% Fibonacci retracement level provides some support but crude crude oil price in this example continued to retrace upto the 50% zone.

50.00% Fibo retracement level provides a lot of support and in this example, this was the ideal place to place a buy crude oil trade order.

For this Oil Retracement Strategy example, the crude crude oil trading price retracement reached the 50.0% Fibonacci retracement level, but most of the time the oil market will retrace up to 38.2% Fibonacci retracement level and therefore most of the time oil traders set their buy limit oil orders at the 38.2% Fibonacci retracement level, while at the same time placing a stop just below 61.8% Fibonacci retracement level.