Trading Gold with Support and Resistance Levels

In the previous tutorial on support and resistance levels we looked at support and resistance levels that were not broken - these levels held because they were strong enough.

However, sometimes support and resistance levels are not strong enough to stop the movement of prices from moving in a particular direction. When the prices move past the support and resistance levels we say that these levels have been broken. This is why traders use stop loss orders when trading these levels, just in case these levels do not hold and price moves past them.

The question is what happens when these zones are broken and prices move past these levels?

The answer is that when these levels are broken they then change from one to the other - what this means is that:

When a support level is broken it becomes a resistance levelWhen a resistance level is broken it becomes a support level

These concepts are explained using the examples below:

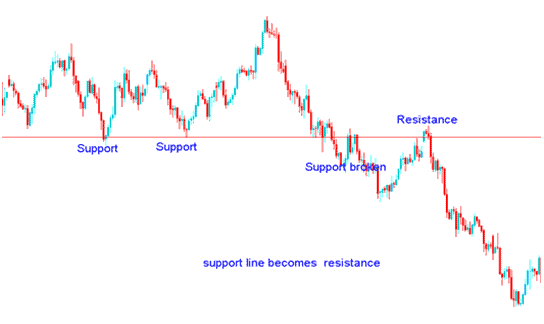

Support Level is Broken - Support Level becomes Resistance Level

In the example below the support level was tested 2 times and this level could not hold the third time it was tested and sellers were able to push the prices of Gold past this level.

Support Level Broken - Becomes Resistance Level

However, the prices of Gold also bounced back up again, but this time the price could not go above this point that was previously a support level - this is because the line that was previously a support level had now turned into a resistance level.

In trading Gold, when a support level is taken out, the stop loss orders placed below that level are also taken out thus reducing the overall momentum that the previous buyers had. This gives an opportunity to sellers to short Gold and then place their stop loss orders just above this level that has now turned into a resistance level.

As long as this resistance level holds and prices don't move above this new resistance level then the market sentiment is bearish and the market prices are likely to continue moving downwards. All in all the traders who will have opened sell trades will place their stop loss orders a few pips above this level.

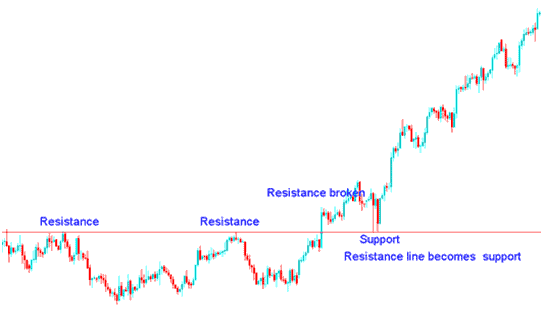

Resistance Level is Broken - Resistance Level becomes Support Level

In the example below the resistance level shown was tested 2 times but could not hold the third time - the buyers were able to push price past this level, thereby breaking the resistance level.

Resistance Level is Broken - Resistance Level Becomes Support Level

When the price of gold broke the resistance level and moved above this level after some time the prices tried to move lower again but could not go lower than this level - this is because the resistance level had now turned into a support level. The prices were quickly pushed further upwards by the buyers after touching this new support level. This is what happens in Gold trading, when a resistance zone is breached it then turns into a support level.

Another reason why the prices of Gold did not move down again is because the sellers who had opened their short trades all their stop loss orders that were placed above this resistance levels were hit therefore reducing the momentum of the sellers.

Major Resistance Levels and Minor Resistance Level

In trading with Gold charts, the resistance and support levels formed are either major resistance/support levels or minor resistance/support levels.

Major Resistance and Support Levels

In major resistance/support levels price will stay at these levels for some time and price may either consolidate or form a rectangle pattern when prices get to this point. This level will be tested several times before it is either broken or holds and price does not get to move past this major resistance/support level.

The above examples are good examples of major resistance/support levels. In the above examples the major resistance/support levels were broken, in the previous tutorial, the major resistance/support levels held and were not broken.

Minor Resistance and Support Levels

Minor resistance/support levels are price points where price will form these short term minor resistance/support levels. Since these are minor resistance/support levels the price will quickly move past these points.

Upward Trend

A series of minor resistance/support levels whose general direction is upwards will be formed.