Trading Gold Using Pivot Points

Pivot Points is a set of technical indicators that were developed by floor traders trading the commodities markets so as to help them identify potential market turning points. These turning points were known as pivots. These pivot points are calculated in order to determine the levels at which the market sentiment of the current trend could change from bullish to bearish or vice versa.

Gold traders use the points as markers of support and resistance levels.

These pivot points are calculated as the average of the high, low and close from the previous trading session:

Pivot Point = (High + Low + Close) / 3

Day traders use the calculated pivot points to determine levels of entry, levels of setting stop losses and levels of setting take profit. Pivot points try to determine where the majority of the traders are setting their trading orders at the same time - when all of the traders are doing the same thing.

In technical analysis, a pivot point is a significant financial market indicator that is used by traders to predict the price movement. This gold indicator is calculated as an average of significant prices (high, low and close) from the performance of market prices in the previous trading period.

Bullish Sentiment - If prices in the following period trade above the central pivot Point: this is evaluated as a bullish sentimentBearish Sentiment - If prices in the following period trade below the central pivot Point: this is evaluated as a bearish sentiment

The central pivot point is also used to calculate additional levels of support and resistance, below and above this central pivot point, respectively - by either adding or subtracting price differentials calculated from previous trading data.

A Pivot and the associated support and resistance levels are often turning points for the direction of the price movement.

In an upward trend - the price stays above the pivot point, the resistance levels may represent a ceiling level for the price and if prices go above these levels then the uptrend is no longer sustainable and a retracement may occur.

In a downward trend - the price stays below the pivot point, the support levels may represent a floor level for the price and if prices go below these levels then the downtrend is no longer sustainable and a rally (pullback) may occur.

The Central Pivot Point is used to calculate the support and resistance levels as follows:

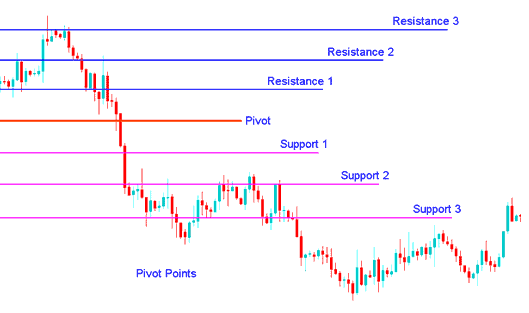

Pivot points consist of a central point level surrounded by 3 support levels below and 3 resistance levels above it. These pivot points were originally used by floor traders trading equities and futures exchange markets mainly because they provided a quick way for the traders to get a general idea of how the market was moving during the course of the trading day using only a few simple calculations. Over time, these pivot points also proved to be exceptionally useful in other markets as well.

One reason why these pivot points are now so popular is because they are considered to be a "leading" (or predictive) indicator rather than a lagging indicator.

All that is required to calculate the pivot points for the upcoming (current) day is the previous day high, low, and closing prices. The 24-hour cycle pivot points in this indicator are calculated according to the following formulas:

The central pivot point can then be used to calculate the 3 support and 3 resistance levels as follows:

Resistance 3Resistance 2Resistance 1Pivot PointSupport 1Support 2Support 3

The Pivot Point indicator is shown below:

Gold Trading Using Pivot Points

Pivot Point Technical Analysis

The central pivot point itself represents a level of the highest resistance or support depending on the overall market sentiment. If the market is range bound and directionless then price will often fluctuate greatly around this level until a price breakout develops.

Prices above or below the central pivot point indicates the overall sentiment as bullish and bearish respectively. Pivot Point indicator is a leading indicator that provides signals of potentially new highs or lows within a given chart time frame.

The support and resistance levels are used as exit points - for example, if the price is trending upwards and prices are above the central pivot, then prices continue to move up to the first and then the second resistance level - then traders can use this second resistance level as a good place to close their buy trade, as the probability of resistance and reversal increases greatly with every resistance level.

In pivot point technical analysis there are 3 levels commonly recognized above and below the central pivot point. These levels are calculated from the range of the price movement in the previous trading period and then added to the central pivot for resistance levels and subtracted from the central pivot for support levels.

Pivot Points technical analysis is used in three ways:

Trend Direction: Central pivot point is useful when determining the general trend of Gold prices. Trades are only opened in the direction of the trend. Buy trades are opened when price of Gold is above the central pivot point and sell trades are opened when the price of Gold is below the central pivot point.

Price Breakout: In a price breakout a bullish signal is when prices break upwards through the central pivot point or one of the resistance levels (typically Resistance 1). A sell signal is when price breaks downwards through the central pivot point or one of the support levels (typically Support 1).

Trend Reversals: In trend reversal, a buy signal occurs when price moves towards a support level, typically Support 2 or Support 3, and the price of gold touches the support level or only moves slightly through it and then reverses and starts moving in the other direction.

A sell signal occurs when Gold price moves towards a resistance level, typically Resistance 2 or Resistance 3, and the price of gold touches the resistance level or only moves slightly through it and then reverses and starts moving in the other direction.