How Do I Trade Classic Bullish Divergence & Bearish Divergence

In Gold trading, classic divergence setup is used as a possible sign for a price trend reversal and it is used by Gold traders when looking for an area where price could reverse and start going in the opposite direction. For this reason this classic divergence trading setup is used as a low risk entry method and also as an accurate way of exiting out of an open Gold trade.

This classic divergence trading strategy is a low risk method to sell near the top or buy near the bottom, this makes the risk on your trades very small relative to the potential reward. However, this is one method with very many whipsaws and most traders do not recommend using it.

Classic divergence setup in Gold trading is also used to predict the optimum point at which to exit an open trade. If you already have an open trade that is already profitable, a good way to spot a profit taking level would be the point where you spot this divergence trading setup.

There are two types of classic divergence - based on the direction of the Gold price trend:

- Classic Bullish Divergence

- Classic Bearish Divergence

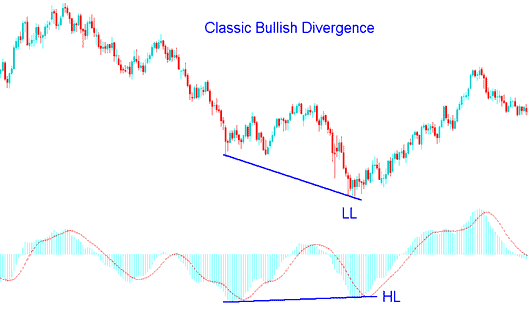

Classic Bullish Divergence

Classic bullish divergence trading setup occurs when price is making lower lows (LL), but the indicator is making higher lows (HL). The example below shows a picture of this classic divergence setup.

Classic Bullish Divergence Trading Setup - Gold Chart

The example above uses MACD indicator as a the divergence indicator.

From the above example the price made a lower low (LL) but the indicator made a higher low (HL), this shows there is a divergence between the Gold price & the indicator. This signal warns of a possible trend reversal.

Classic bullish divergence trading signal warns of a possible change in the Gold price trend from downward to upwards. This is because even though the price moved lower the volume of sellers that moved price lower was less than before when you compare the two lows - as illustrated by the MACD technical indicator.

This indicates underlying weakness of the downward Gold price trend.

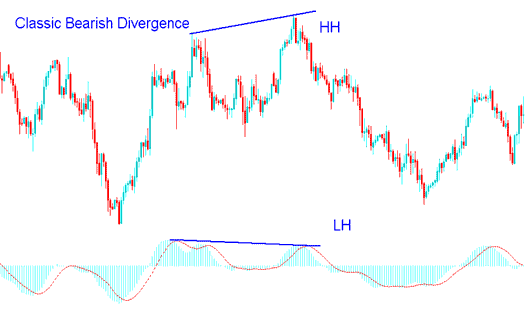

Classic Bearish Divergence

Classic bearish divergence trading setup occurs when price is making a higher high (HH), but the oscillator is making a lower high (LH). The example below shows this of the classic bearish divergence trading setup.

Classic Bearish Divergence Trading Setup - Gold Chart

The above example also uses MACD indicator

From the above example the price made a higher high (HH) but the indicator made a lower high (LH), this shows there is a divergence between the Gold price & the indicator. This signal warns of a possible trend reversal.

Classic bearish divergence trading signal warns of a possible change in the Gold price trend from upward to downwards. This is because even though the price moved higher the volume of buyers that moved price higher was less as illustrated by MACD.

This indicates underlying weakness of the upward Gold price trend.

In the examples above, if you had used classic divergence trading setups to trade you would have gotten good trading signals to enter or exit the trades at an optimal point. However, divergence trading signals just like other trading indicators is also prone to whipsaws. That is why it's always good to confirm the divergence trading signals with other technical indicators such as the RSI, Moving Averages and Stochastic Oscillator before opening a trade.

A good indicator to combine classic divergence trading setup is the stochastic oscillator and wait for the stochastic lines to move in the direction of the divergence trading signal so as to confirm the trading signal.

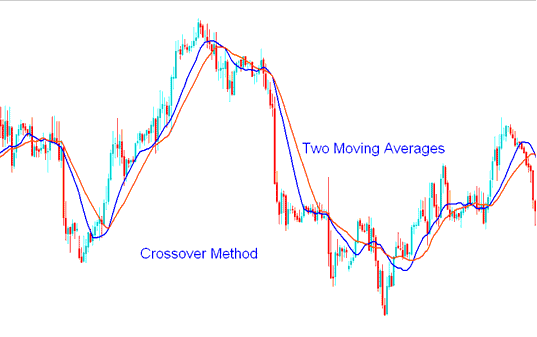

Another good indicator to combine with this setup is the moving average indicator, in this indicator a trader should use the Moving Average Crossover System to confirm the trade signal generated by the divergence trading setup.

Example of MA Crossover Method

Moving Average Crossover Trading Method Combined with Classic Divergence Trading Setup

Once the divergence trading signal is given, a trader will then wait for the Moving average cross-over method to give a trading signal in the same direction, if there is a classic bullish divergence trading signal, a trader will wait for the moving average crossover method to give an upward crossover signal, while for a bearish classic divergence trading signal the trader should wait for the Moving average cross-over system to give a downward bearish crossover trading signal.

By combining the classic divergence trading signals with other technical indicators this way, a trader will be able to avoid whipsaws when it comes to trading the classic divergence trading signals, because the trader will wait til the market has actually reversed and is already moving towards the generated signal direction -hence the trader will not fall into the trap of picking market tops and market bottoms by entering transactions before the actual divergence trading setup has been confirmed.