Buy Entry Limit Order and Sell Entry Limit Order - How to Set Entry Limit Orders

Limit Order Definition - An entry limit is an order to buy or sell Gold at certain price that is a pullback area where price is predicted to retrace to before it resumes the original trend. Traders use limit orders to buy or sell at a better price.

An entry order of this type can be used to open buy below the market level (during a retracement in an upward trend) or to sell above the market level (during a pullback in a downward trend).

Buy Limit Order - When buying, your entry buy limit pending order is executed when the market falls to your set price. (Price retraces down)Sell Limit Order - When selling, your entry sell limit pending order is executed when the market rises to your set price. (Price retraces up)

Entry limit orders are set by traders when they expect the price to bounce back after reaching the retracement level where they use have set their orders.

Buy Limit OrderOrder to buy at a level below the current market price

Sell Limit OrderOrder to sell at a level above the current market price

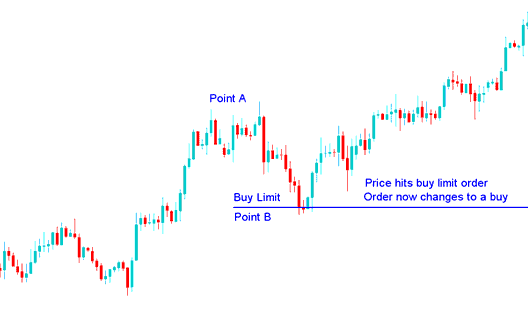

Buy Limit Example

In the example below a buy limit order was placed to buy at a price that was lower than the current market price - The buy limit order is set at point B.

Buy Limit Order Placed Below the Current Price

The price then retraced and went down to hit the buy entry limit order. When the buy limit order was executed it changed into a buy trade - afterward price continued to move upwards in the direction of the original market trend as shown below.

Buy Limit Order Executed - Order Now Changes to a Buy Trade

After the buy limit order was executed it then changed into a buy trade - the original upward trend then resumed and price continued moving upwards. A trader using this type of order buys at a better price after a retracement. A trader should also know where is the best place to set these entry buy limit orders so that they do not set this order to far that the retracement does not get to their set order and they miss out on the trade and they should also not set it very close, traders should use Fibonacci Retracement levels to know where is the best place to set their entry buy limit orders.

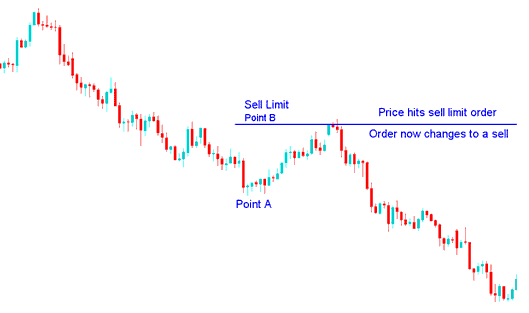

Sell Limit Example

In the example below a sell limit order was placed to sell at a price that was higher than the current market price - The sell limit order is set at point B.

Sell Limit Order Placed Above the Current Price

The price then rallied and went up to hit the sell entry limit order. When the sell limit order was executed it changed into a sell trade as shown below - afterward price continued to move downwards in the direction of the original market trend as shown below.

After the sell limit order was executed it then changed into a sell trade - the original downward trend then resumed and price continued moving downwards. A trader using this type of order sells at a better price after a retracement. A trader should also know where is the best place to set these entry sell limit orders so that they do not set this order to far that the retracement does not get to their set order and they miss out on the trade and they should also not set it very close, traders should use Fibonacci Retracement levels to know where is the best place to set their entry sell limit orders.

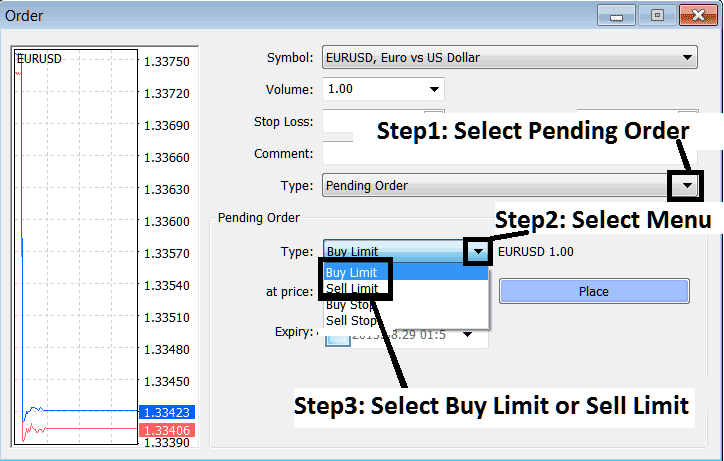

Setting Buy & Sell Limit Orders on MetaTrader 4 Software

To set up these Gold trading orders on the MetaTrader 4 platform, Right click on Forex chart>>> Select "Trading">>> Then Select "New">>> Then on the popup window that appears (illustrated below), under the label "Type" select option of "pending" instead of "market execution">>> Under the pending order options choose pending order type: for This trade select either "Buy Limit" or "Sell Limit" depending on whether you want to place a pending buy or sell.

Placing Limit Orders on MetaTrader 4 - Buy Limit and Sell Limit