Do You Have to Use Leverage in XAU USD?

The meaning & definition of Leverage can be defined as having ability of controlling a big amount of money while using little of your money & borrowing the rest - this is what makes the market to attract many traders.

We will first talk about borrowing power, then gold money needed, in this lesson on how to figure out xauusd borrowing power and money needed for gold.

Gold Example:

Using leverage can enhance trading potential. If your broker offers a leverage ratio of 100:1, it is generally regarded as an optimal choice for maximum account management flexibility.

This means you borrow $100 for each $1 you have on your xauusd account.

In other terms your online broker provides you $100 for each one dollar on your trading account. This is what is referred to as leverage.

This means if you open a account with $1,000 & your leverage option is 100:1, then you get $100 for every $1 which you have on your trading account, the total amount which you will control is:

If for $1 the broker provides you 100

Then if you have 1,000 in your account you will get a total of:

$1,000 * 100 = $100,000

Now you control $100,000 of Capital after applying leverage

A common query from newer traders revolves around optimal leverage for balances of $2,000, $5,000, or $10,000: the recommended maximum leverage ratio for opening a live account is 100:1, rather than the higher 500:1 setting.

What's XAUUSD Gold Margin?

XAU/USD margin is the money your broker needs you to have so you can keep trading gold with leverage.

Another way to ask about margin in gold trading is to say it's the money your online broker needs to hold open positions, shown as a percentage. With 100:1 leverage, you'll control $100,000, as the picture above explains.

Now how can you compare an investor who is investing $1,000 with another one that is investing $100,000? Obviously You Can't. This is how leverage works in gold trading, it takes & moves you from the guy investing with $1,000 to the one investing $100,000. Where does the extra money originate and come from? You borrow from your broker in what is simply known as XAUUSD Leverage. This money that you borrow from your broker, you as a trader borrow it against the $1,000 of your own funds that you deposit with your broker in your account. If you were to define what this leverage means - then leverage is the ability to control a big amount of money using very little of your own money and borrowing the rest. Otherwise, if you were trade gold without this leverage it wouldn't be as profitable as it is, in fact you can still choose not to use this leverage, using the 1:1 leverage ratio but you would not make money it would take too long to make any gold profit.

Example of how to calculate xauusd leverage and margin:

The Gold Margin needed here is $1,000 (your money) if it's shown as a percentage of the $100,000 you control in your account, it is:

If leverage option = 100:1

1,000 / 100,000 * 100= 1%

XAU/USD Margin required = 1 %

(1/100 *100= 1%)

"Trade FX - Simplify a bit please because I am a Beginner"

Simplified, if your gold trading capital is $1,000 and leverage allows you to control $100,000, then $1,000 represents 1% of $100,000. This percentage reflects your XAU/USD margin requirement for trading.

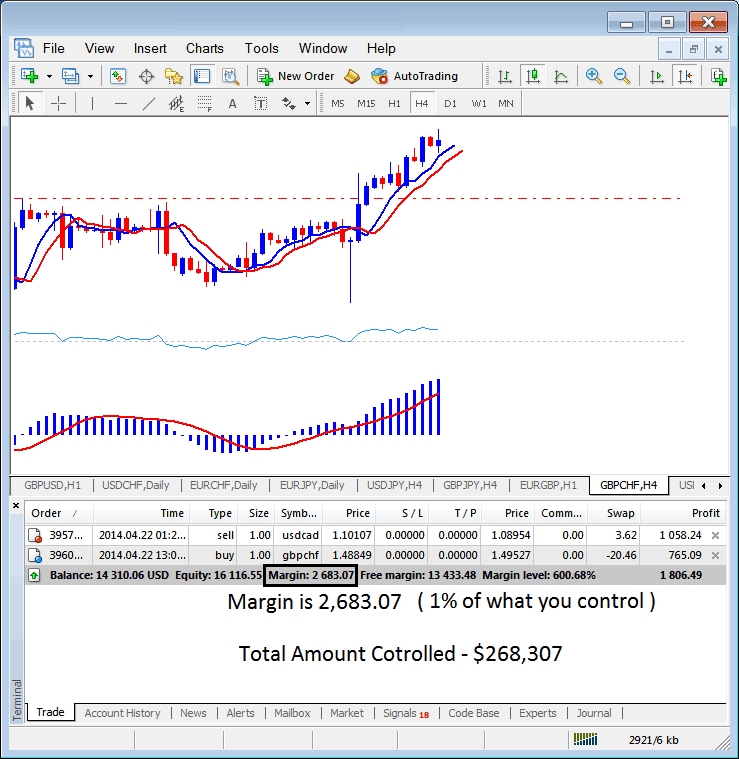

Check the gold margin example below. Leverage is set at 100:1. The margin is 1%, or $2683.07. So the trader controls $268,307 total. With this setup, they use just 1% of their own cash and borrow the rest. That 1% comes to $2683.07. Full value then hits $268,307.

MetaTrader 4 Transactions Panel - What Amount of Leverage Should Beginner Gold Traders Use? - Do You Need to Use Leverage with Gold?

- If = 50:1 Leverage Ratio

Then xauusd margin needed = 1/50 100= 2 percentage

If you have $1,000,

1,000* 50 = $50,000.

1,000 divided by 50,000 times 100 equals 2 percent

Simplify: Your gold account holds $1,000. With leverage, you control $50,000. That $1,000 is 2% - your XAU/USD margin need.

- If = 20:1 Leverage Ratio

Then the gold margin requirement = 1/20 *100= 5 %

If you have one thousand dollars,

1,000* 20 = $20,000.

1,000 / 20,000 * 100= 5 %

(Simplify - your gold equity is $1,000 after leverage you now control $20,000 - $1,000 is what percentage of $20,000 - it is 5 %) that's your trading margin requirement

- If = 10:1 Leverage Ratio

The margin requirement for the xau/usd is then equal to 1/10 100, or 10%.

If you have $1,000,

1,000* 10 = $10,000.

1,000 / 10,000 * 100= 10%

As a trader, print a chart if you want. Analyze it later or keep it as a trade record in your journal.

What is the Distinction Between Maximum Leverage and Used Gold Leverage?

It is important to recognize the distinction between maximum leverage (the highest leverage ratio offered by your XAUUSD broker, which you have the option to use) and used leverage (the actual leverage level determined by the gold lot sizes of the open trade positions you have initiated). One represents the broker's limit (Maximum Gold Leverage Ratio), while the other represents the trader's application (Used Leverage Ratio). To clarify this leveraging concept, we will analyze the illustrative example shown above:

If your online broker has given you 100:1 Max Gold Leverage Ratio, but you only open/execute a trade of $10,000 then Used Gold Leverage is:

$10,000: $1,000 (your capital)

10:1

You've used 10:1 Leverage Ratio, but your max leverage ratio is still 100:1 Leverage. This means that even if you are given 100:1 Maximum Leverage Ratio or 500:1 Maximum Gold Leverage Ratio, you don't have to use all of it. It is best to keep your used leverage option to a maximum of 10:1 leverage but you will still choose 100:1 maximum leverage ratio for your account. The extra leverage gives you what we call Free Gold Margin, As long as you have Free margin on your trading account then your positions will not get closed by your xauusd broker because this margin requirement will remain above the required level based on the free margin in your account.

One key rule for gold trading: keep your leverage below 5:1 as part of your money management plan.

In example illustration revealed above, the gold trader is using $2683.07 dollars, total controlled amount is $268,307 dollars, but equity is $16,116.55, henceforth used leverage is ($268,307 divided by 16,116.55) = 16.64 : 1

16.64 : 1 Used Gold Leverage Ratio

XAUUSD margin accounts let traders use a small amount of their own money to control a large amount of currency, while borrowing the rest.

Securing this gold margin account will grant you the ability to leverage borrowed funds from your online broker for trading xauusd lots.

The leverage provided by your margin trading account is the amount of borrowing power it provides, and it is typically expressed as a ratio. For example, a leverage ratio of 100:1 indicates that you have access to resources that are 100 times the amount of your deposit.

In terms of gold trading, having a 1% margin in your account enables you to control a standard gold lot or contract valued at $100,000 with just a $1,000 deposit.

Nonetheless, engaging in trading with this margin account elevates both the potential for gains in gold and the possibility of gold-related losses. Within gold trading, your maximum loss is capped at the amount you originally invest: losses are confined to your deposited funds, and typically, brokers will close any trade extending beyond your balance via a XAUUSD margin call. Consequently, traders must endeavor to maintain their gold margin level above the requirement set by their broker, by implementing sound equity management practices and keeping their utilized leverage ratio under 5:1.

What is Gold Leverage for Gold Beginner Traders? - Do You Have to Use Leverage in Gold? - Leverage in Gold - Leverage Example - Leverage and margin made clear - Leverage Calculator

More Instructions and Educations: