What is Doji Candles in Gold Trading?

What Does Doji Candle Mean? - Doji Candle Definition

Doji is a candlestick pattern with same opening and closing xauusd price. There are various types of doji candlestick patterns that form on charts.

A doji candlestick is where xauusd trading price on a gold chart for a specific trading time period closes almost at the same xauusd price. Doji candles look like a cross, inverted cross or a + math sign.

following examples explain various patterns of the doji candle:

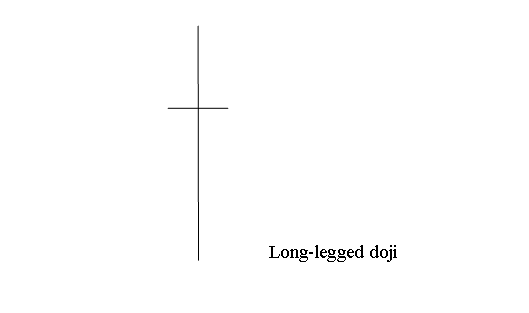

Long-legged doji candlestick has long upper and lower shadows with the opening and closing xauusd trading price at the middle. When the Long-legged doji pops up on a Gold chart it indicates indecision between xauusd traders, buyer & the sellers.

Below is example screen shot image of the Long Legged

What is Doji Candles in Gold Trading? -Technical Analysis of Doji Candle Pattern

Cross Doji Gold Trading Candlestick

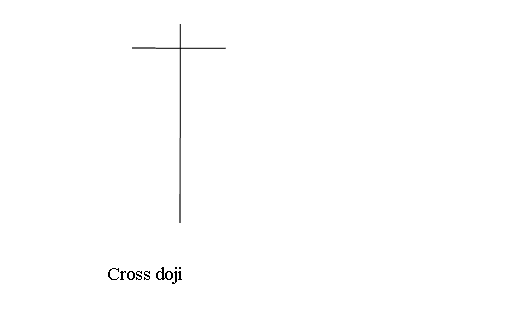

Cross doji candlestick pattern has a long lower shadow & a short upper shadow & the open & close of the day is the same.

This gold candlestick pattern pops up at market turning points & warns of a possible gold trend reversal in the gold market. Below is as example of this Cross doji candlestick formation

Cross Doji Candlestick Pattern - Technical Analysis of Doji Candle Pattern

Inverted Cross Doji Candle Pattern

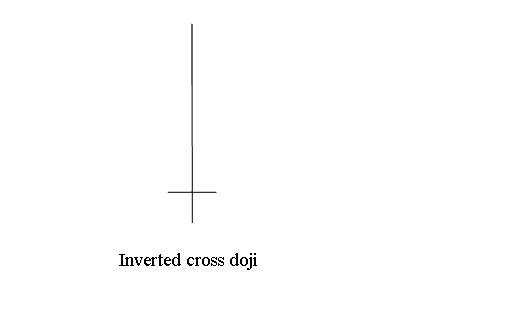

Inverted cross doji candle pattern - candlesticks have a long upper shadow & a short lower shadow and the open & close is the same.

This reversal doji candlestick pattern appears at market turning points & warns of a possible gold trend reversal in the gold market. Below is an example of this reversal doji candle pattern

Inverted Cross doji XAUUSD Candlestick Pattern - Technical Analysis of Doji Candle Pattern

Analysis of Doji Candlestick Pattern - All doji candlesticks pattern explain indecision in the Gold Trading market this is because at the top the buyers were in control, at the bottom the sellers were in control but none of them could gain control & at the close of the xauusd market the xauusd trading price closed unchanged at the same xauusd trading price as the opening xauusd trading price.

This doji candle pattern shows that the overall xauusd trading price movement for that day was zero pips or just a minimum range of 1-3 pips. Reading these candlesticks patterns need very small pip movement between the opening xauusd price & closing xauusd trading price.