What is Consolidation?

Gold Price consolidation in gold trading is when prices stop moving upwards or downwards in a gold trend & start to move sideways in what is known as a consolidation.

Gold Price will continue to consolidation and move sideways for a period of time until such a time that one side of the xauusd market - either the buyers or the sellers gain control of the xauusd market and either push xauusd prices upward in an upward gold trend or push xauusd prices downward in a downwards trend.

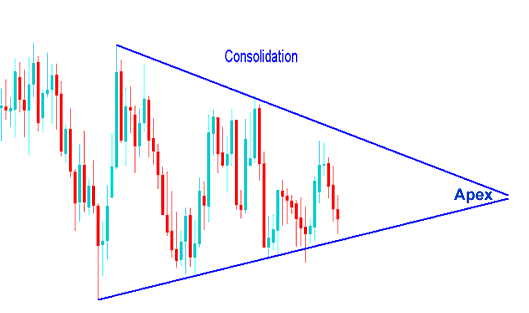

Consolidation Trading Patterns

Symmetrical triangles are xauusd chart patterns with converging gold trend lines that form a consolidation period and are used to trade the xauusd price consolidation.

Technical buy point from symmetrical triangle is the up-side break of xauusd price consolidation, while a downside break of the xauusd price consolidation is a technical sell signal. Ideally, a market breaks-out from a symmetrical triangle prior to reaching apex of the triangle.

When these xauusd price consolidation patterns form we say that the Gold market is taking a break before deciding which is the next direction to take.

What is Consolidation in Gold Trading? - What is Gold Price Consolidation in Gold Trading?

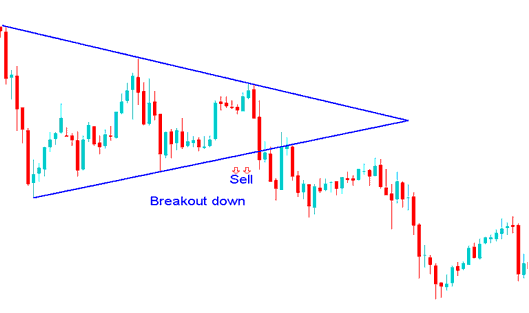

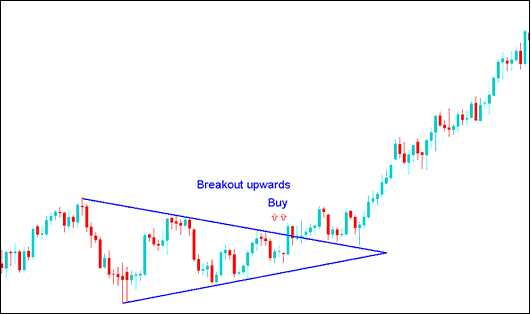

However, this xauusd price consolidation pattern can't go on forever & just like in a tug of war one side eventually wins, below are two example of how xauusd price consolidation eventually had a breakout pattern and moved in one direction.

Gold Price Breakout Downwards Sell Gold Trading Signal after a Consolidation - What is Consolidation in Gold Trading?

Gold Price Breakout Upwards Buy Gold Trading Signal after a Consolidation - What is Consolidation in Gold Trading?